BNP Paribas AM: The current correction as an investment opportunity

Global equities sold off aggressively as higher bond yields finally dented the strong January risk rally. We remain constructive on other markets where the fundamentals are strong.

09.02.2018 | 08:58 Uhr

A technical rather than fundamental correction

2018 began on a very strong footing as financial markets priced in a reflation environment with both risky assets and bond yields rising for most of January. Most major equity markets started correcting in late January, but it was not until Friday 2 February that the correction in risky assets deepened. This followed an upside surprise in the latest date on average hourly earnings in the US, which rose to 2.9% YoY, beating consensus estimates of 2.6%.

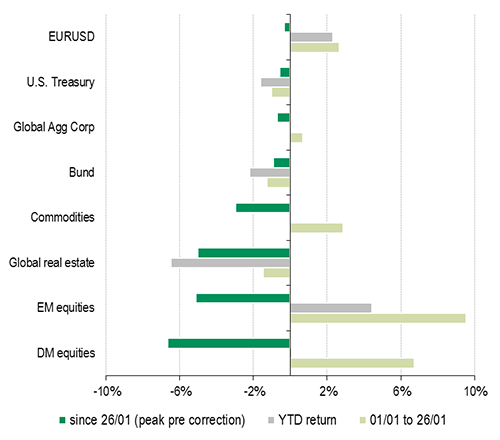

The correction has been aggressive but it has been concentrated in global equity markets (Figure 1). Indeed, the sell-off in other risky assets has been orderly. Government bonds had been falling over the course of the month and the equity plunge has so far not led to a typical ‘flight to bond safety’ as seen in recent years. The 4% fall in the S&P 500 equity index on 5 February is the largest daily drop since August 2011 and the spike in US implied equity volatility (as reflected in the VIX index) was the biggest since April 2009.

Figure 1: February correction erases January performance mainly for equities

(Source: Bloomberg, BNPP AM)

There are various reasons that make us believe that this correction is technically driven.

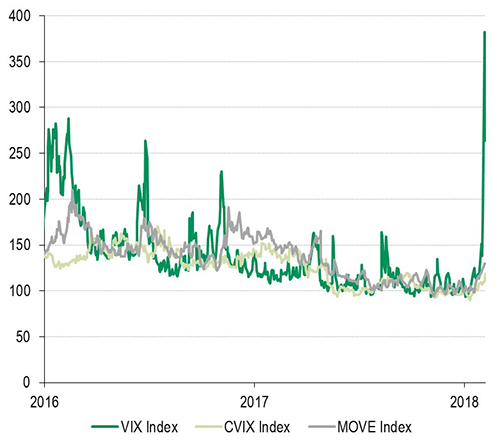

First, volatility in other markets has not spiked in a similar fashion. Rates and FX volatility, for example, had risen in January but remain contained compared with the VIX (Figure 2). Other ‘high-beta’ assets such as commodities, EM currencies and bonds do not appear as dislocated.

Second, there is evidence that systematic strategies such as volatility targeting, risk parity, CTAs and short volatility are facing outflows as volatility rises.

Third, macroeconomic fundamentals remain on the whole robust. The strength in activity data is broad-based, with US and European purchasing managers’ indices (PMIs) posting cyclical highs recently and EM GDP growth catching up with that in the developed world.

Figure 2: Implied equity volatility (VIX) spiked sharply,

but rates and FX volatility remain contained (index=100 on 01/01/2018)

(Source: Bloomberg, BNPP AM)

Inflation data has remained low, but markets have fundamentally reassessed the inflation outlook. Under our central scenario (‘Goldilocks’), we assume inflation in the US will close the year at 2.0%, while our main alternative scenario (‘inflation surprise’) assumes US inflation rises to 3.0% by the end of 2018. Given the recent compression of core yields, we believe some re-rating of fixed-income yields was inevitable, even in our central scenario.

We flagged the tension between robust fundamentals and fragile market dynamics in our 2018 Investment Outlook. We noted that such tension could lead to sharp corrections and potentially a more defensive stance.

Following this correction, our view remains that it is too early to shift away from our central scenario or to call an end to the late-cycle expansion. We are still constructive on risk assets and would cautiously take the current correction as an opportunity to add long equity exposure in our portfolios.

In particular, we would be looking for opportunities in equity markets where the correction is material and the fundamentals are strong such as in European equities. The EuroSTOXX 50 index is near technical levels that look appealing to us. The monthly series, for example, is close to the 20-month moving average (Figure 3). We also favour Japanese and EM equities. We remain underweight fixed income structurally given the risk of higher inflation and higher rates, but we have taken profits tactically after the sharp sell-off in Bunds.

Read the full report here.

Diesen Beitrag teilen: