Electric vehicles: driving growth in semiconductors

Doug Rao, Co-portfolio Manager for the US Concentrated Growth Strategy, shares why he believes semiconductor content in autos could grow at a double-digit rate over the next decade.

07.05.2018 | 12:23 Uhr

As a rule, my team keeps an eye toward businesses that have powerful tailwinds associated with them, and we spend a lot of time trying to identify these and the secular megatrends behind them. By secular, we mean the trend is not short term in nature, but one that will endure for many years to come.

As a rule, my team keeps an eye toward businesses that have powerful tailwinds associated with them, and we spend a lot of time trying to identify these and the secular megatrends behind them. By secular, we mean the trend is not short term in nature, but one that will endure for many years to come.

(Source: iStock)

One particularly compelling megatrend, in our view, is the continued growth of semiconductor content in the automotive industry. In 2016, some US$30 billion in semiconductor content was present in autos, which translates to roughly $300 per vehicle. Over the next decade, we expect this number to approach $100 billion, or nearly $1,000 per vehicle.

We see two key drivers of this growth. The first is the transition of the automobile fleet from internal combustion engines (ICE) to electric vehicles (EV). The second is the transition from human-driven cars to autonomous vehicles.

We are quite optimistic about the transition of the global auto fleet to EV for a number of reasons. Historically, the primary limiting factor for EVs has been cost of the powertrain. Up to now, traditional gasoline engines have been significantly cheaper than battery-powered ones.

However, due to advancements in both chemistry and manufacturing scale, we are nearing cost parity between gasoline-powered and battery-powered engines. True cost parity will occur when battery costs drop to roughly $125/Kwh. Depending on the literature one reads, this looks likely to occur at some point over the next three years. Other advantages of EVs include lower maintenance costs, markedly lower emissions, and an enhanced safety profile due to a much larger front impact crumple zone.

Consider the continuum: Levels 0 to 5

Looking at the transition from human-driven to autonomous vehicles, significant ink is being spilled today by the media about the safety, or lack thereof, of autonomous vehicles. We do not have much to add to this debate because we think it misses the point. The media are framing this as a binary event – either the driver drives the car or the car drives itself. This is not the case.

In reality, there is a whole continuum of steps between complete driver control and a vehicle being fully autonomous. In fact, there is an industry-defined categorisation around this continuum, starting at Level 0, which is a totally human-controlled car, up to Level 5, which is a fully autonomous vehicle. Today, many auto original equipment manufacturers (OEMs) are designing cars for production that are somewhere between Level 1 and Level 3 — or more akin to improving the active safety of a human-controlled car (think automatic emergency breaking). Tesla appears to be focused on Level 4, and Google’s self-driving car unit, Waymo, is entirely focused on building a Level 5 vehicle.

We expect the twin drivers of EV and autonomous cars to materially increase the semiconductor content per vehicle.

The EV investment case: venturing further

Over the past several years, we have been of the view that the traditional auto industry was underappreciating the ultimate EV penetration rate. Up until about nine months ago, many auto industry executives believed that only 3% to 5% of new cars would be electric in 2025. Now, many in the industry believe the penetration of EVs as a percentage of new car sales could approach 30% in 2025.

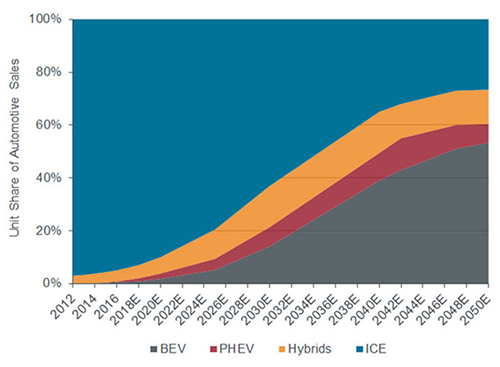

Chart 1: Unit share of EV auto sales forecast to accelerate

(Source: Bloomberg New Energy Finance as at June 2017, data from 2012 onwards and estimates (E) for 2018 until 2050. BEV = battery electric vehicle; PHEV = plug-in hybrid electric vehicle; ICE = internal combustion engine. Data is for illustrative purposes only and is not an investment recommendation.)

Volkswagen, for example, recently announced an ambitious plan to spend $50 billion over the next seven years to build 15 EV plants and wants one-third of its production to be EV by 2025. The Chinese appear to be even more ambitious with their plans, and several countries in Europe are moving to outlaw ICE vehicles by 2040.

But again, just as in the case of the transition to autonomous, the transition to EV does not have to be binary. There is a continuum of powertrains (hybrid electric, for example) that will help bridge the transition. IHS Markit estimates that a mild hybrid has $428 of incremental semiconductor content, while a plug-in hybrid electric and a full EV both have more than $700 in incremental semiconductor content.

Cars with active safety features simply need new equipment that does not broadly exist in today’s vehicles, such as cameras, radar, lidar and sensor fusions. Infineon, a German semiconductor company, estimates that at Level 2 the incremental semiconductor content per car is $150. At Level 3, this number jumps to $580. At Levels 4 and 5, Infineon estimates that a car would need an additional $860 in silicon* per vehicle.

Added together, a car that is both an EV and has Level 4 autonomy should have close to $2,000 in semiconductor content – roughly six times the average semiconductor content in a vehicle today.

In conclusion, we see a number of building blocks in place for semiconductor content in autos, such that it could grow at a double-digit rate over the next decade. Texas Instruments and TE Connectivity are stocks that could potentially benefit from the tailwinds we have identified.

*silicon is the main semiconductor material used.

Glossary:

Kilowatt hour (Kwh) = a measure of electrical energy equivalent to a power consumption of one thousand watts for one hour.

Lidar = a detection system which works on the principle of radar, but uses light from a laser.

Powertrain = encompasses every component that powers a vehicle’s movement

Diesen Beitrag teilen: