Henderson: Global natural resources: rise of the mega-merger

A profound wave of consolidation by the world’s biggest agriculture companies is completely transforming the dynamics of the sector. David Whitten, Head of Henderson's Global Natural Resources Team, discusses the situation and the potential outcomes.

26.10.2016 | 10:25 Uhr

Led by the agricultural sector, an astonishing 37% of companies by weight in the S&P Global Natural Resources Index are currently in mergers or takeover. This sweeping change could give rise to one-stop-shop offerings from a small number of global agricultural companies, offering products across the entire industrial food chain. The wave of mega-mergers in the world’s biggest agriculture companies could see the biggest six listed companies become four dominant players. While economic challenges in faltering emerging markets and strong investor demand have played a role, the longer-term strategic drivers of these consolidations are likely to be recognition of the opportunity to provide farmers with an ‘integrated’, full service suite, and the globalisation of the agriculture sector.

Six become four?

In 2013, the top six listed firms controlled 75% of the agrochemical market and 63% of the commercial seed market1. The three major merger and acquisition (M&A) deals that are currently in progress could see the six become four, comprising three giant companies and a single medium-sized player.

ChemChina and Syngenta

In February 2016, ChemChina, a state-owned entity and China’s largest chemicals company, made a $43bn cash bid for Syngenta, a leading Swiss-based seed and crop protection company. If successful, this will be China’s largest global acquisition.

Monsanto and Bayer

Monsanto, the world’s largest seed company, agreed in September 2016 to be acquired for $66bn by Germany’s pharmaceutical and life science conglomerate, Bayer. Once regulatory approvals are received, Bayer’s acquisition of Monsanto will be corporate Germany’s largest. With Bayer’s strength in crop protection (herbicides, pesticides and fungicides) it is clear to see how a combined company could deliver an integrated offering.

DuPont and Dow Chemical

Two of the world’s largest chemicals companies DuPont and The Dow Chemical Company are currently merging as equals and intend to spin-off three independent companies, one of which becomes a very large, pure-play agricultural company that unites their seed and crop protection businesses into a single and more powerful entity. This proposed company could potentially account for approximately 40% of the corn and soybean seed market in the US2.

BASF

BASF is the sixth top listed firm. BASF is the third largest agrochemicals company behind Syngenta and Bayer, with €5.8bn in crop protection revenues for the 2015 financial year3.

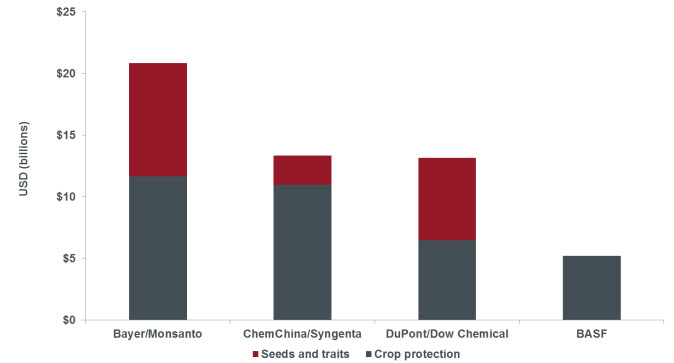

Chart 1: Pro forma global sales, 2015 (USD billions)

Source: Bayer Investor presentation, as at 8 June 2016.

The scale of the mergers taking place has necessitated other companies to propose their own mergers in a bid to compete with these larger, consolidated companies, or face the prospect of being squeezed out of the market. While not all applications will pass, with such a large proportion of the market in M&A, there is a view that US and European Union antitrust regulators will progressively clamp down on proposals as competition reduces. For this reason, a large proportion of companies are pushing their applications through.

What can we learn from history?

Some commentators have suggested that if the current round of announced consolidation occurs, the combined companies will dominate the global crop chemical market, with a market share approaching 90%. For natural resource investors, there is perhaps an uncanny similarity to the iron ore mining and oil and gas industries more than 16 years ago.

In the late 1990s and early 2000s, the mining industry was in a very similar consolidation phase with mergers between BHP and Anglo-Dutch Billiton and Xstrata, Anglo American, Vale and Rio Tinto acquiring a number of other mining companies. At that time, the main drivers of consolidation were the need to cut costs following the turmoil of the Asian financial crisis and ultimately to meet the growth needs of China. These mergers led to a mining sector that was dominated by a few large entities and over the last 20 years, dominated the supply of high-margin iron ore to meet the rapid growth in demand and improved pricing for iron ore from China for its steel infrastructure needs.

In the energy sector, three energy mega-mergers over 1998-2001 similarly created giant resource companies that enabled the combined companies to take advantage of economies of scale and to fund the risks of finding and developing oil in frontier regions.

The Exxon/Mobil, BP/Amoco, and Chevron/Texaco mega-mergers were undertaken in response to weak oil prices and the need to reduce costs and enhance scale. The coming together of Exxon/Mobil created an estimated $2.8bn4 in savings and BP/Amoco saw estimated savings of $2bn5. Like the current wave of M&A in agriculture, it took a long time to obtain antitrust regulatory approvals. In the Exxon/Mobil merger it took one year to gain antitrust regulatory approval, probably a good indication of the time required to complete the mega-deals in agriculture.

The difference in the agriculture sector is that perhaps the barriers to entry may be even higher than mining and oil and gas, and hence the chance of excess long-term higher returns may be greater for longer. In addition, perhaps the risks of gaining regulatory approval will therefore also be higher.

Further, similar to the steel companies’ concerns at the time following the consolidation of the iron ore industry, the agriculture sector may well undergo an end-user backlash by farmers.

What could be next?

Could farming machinery also be looking at M&A opportunities within the wider agricultural sector? While only speculation, an integrated offering between machinery and the other elements involved in sowing, protecting, fertilising and harvesting makes a lot of sense and could be a logical next step.

Among the fertiliser subsector, large mergers are also in progress with Agrium and Potash Corp which are currently looking to an all-share merger to create the world’s largest crop nutrient supplier with a market value of about $27bn. The deal will give Potash Corp shareholders 52% of the new company. With the currently weak potash and nitrogen prices and the imperative to reduce costs, additional M&A activity in the fertiliser sector is considered likely.

What are the implications?

The only certainty is that the agricultural equity space in the future will be very different to the sector we see today. We expect companies that sit in the mid-range and lack the market share, capital and research and development budgets to compete are in potential danger. Nimble and innovative companies with niche offerings will always have their part to play, but where the offering is a direct competitor to the larger players, it is a very tough outlook indeed.

The constant and evolving threat of pests and diseases, and the growing challenges from climate change require constant innovation to develop seeds with new traits and enhancements in crop protection science. Food security has emerged as a national priority and ensuring that crops and harvests are protected is a national security concern. Typically research and development (R&D) budgets as a percentage of annual revenue at large global agribusinesses are approximately 10-11%, so the potential from these larger, globalised companies to innovate at scale is greatly enhanced.

Not all of the outcomes will be clear in the short to medium-term, as once regulators have approved, the process of merging and integrating into large companies can take some time, and a lot of the strategic gains can be longer-term in nature.

Agriculture has indeed joined energy and mining as the ‘third leg’ of natural resource investing and global agricultural equities will continue to provide ‘fertile’ investment opportunities.

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Dollar amounts are in US Dollars (USD) unless otherwise specified.

1. ETC Group. As at 22 October 2015.

2. http://www.wsj.com/articles/dow-chemical-and-dupont-are-in-advanced-talks-to-merge-1449621799

3. BASF Annual Report 2015.

4. http://blogs.wsj.com/deals/2010/11/30/exxon-mobil-12-years-later-archetype-of-a-successful-deal/

5. Kumar, B. Rajesh. Mega Mergers and Acquisitions: Case Studies from Key Industries. 2012.

Diesen Beitrag teilen: