Morgan Stanley IM: Fixed Income Outlook 2018 – A Focus on Alpha

As the new year begins, it’s difficult to see what will disrupt this not-too-hot, not-too-cold environment: growth continues to surprise on the upside, but inflationary pressures remain dormant, implying the unusually slow pace of central bank policy normalization will continue.

10.03.2018 | 12:06 Uhr

There is also a notable lack of enthusiasm among investors. Cash allocations are high, market commentary focuses on how expensive markets are and how risks are growing. A buy the dip mentality frequently means one will likely not materialize! However, market skepticism about value and the ability of indexes to drive returns does have validity. In this positive macroeconomic, somewhat high valuation world, alpha/issuer selection is likely to be a far bigger driver of performance than just being long risk. Indeed, given their greater diversity of macroeconomic situations, emerging markets may be an attractive space to look for alpha opportunities.

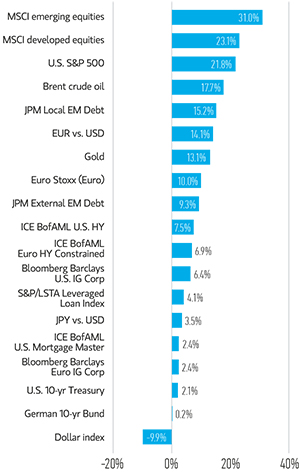

| DISPLAY 1: Asset Performance Year-to-Date |

Will 2018 be as good to investors as 2017? Most assets performed well last year as the combination of sustained economic expansion and continued easy financial conditions buoyed risky assets. There is also a notable lack of excitement among investors. Cash allocations are high, market commentary focuses on how expensive markets are and how risks are growing. A buy the dip mentality frequently means one will likely not materialize! However, market skepticism about value and the ability of indexes to drive returns does have validity. In this positive macroeconomic, somewhat high valuation world, alpha/issuer selection is likely to be a far bigger driver of performance than just being long risk.

There are always things to worry about, from central bank policy surprises to geopolitical explosions. We believe one of the key risks, if not maybe the most important risk, for 2018 is not so much the macroeconomic picture turns unfavorable, but that the market’s demanding expectations are not met. Central banks may still normalize policy very slowly in comparison to previous cycles, but it won’t take much to exceed current market pricing, e.g., if the Fed raises rates more than twice, if the European Central Bank (ECB) ends quantitative easing (QE) in September, or if the Bank of Japan (BoJ) shifts at all on its yield curve control policy. With the composition of the Federal Open Market Committee (FOMC) still in flux, U.S. President Donald Trump has several more appointments to make. Given current valuations, the skew in potential outcomes for government bond markets is towards yields moving meaningfully higher rather than lower. Therefore, even if one’s central scenario is not very different from what the market expects, we believe it makes sense to position for higher yields.

In spread product, the concern is that even a benign economic outlook may not be enough to drive outperformance given the spread compression that has already happened. One will need to be far more selective in where one takes spread risk to help both eke out higher returns and minimize potential losses in a sell-off. Alpha/issuer selection is likely to be a far bigger driver of performance than just being long beta/carry. Given the greater diversity of macroeconomic situations, emerging markets may be an attractive space to look for alpha opportunities.

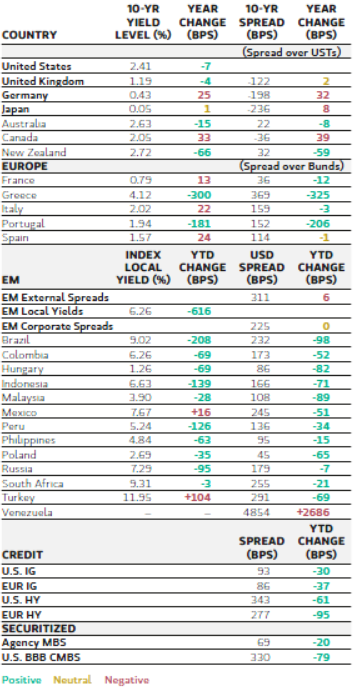

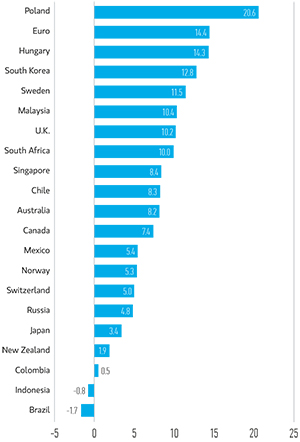

| DISPLAY 2: Major Yearly Changes in 10-Year Yields and Spread | DISPLAY 3: Currency Monthly | |

(Source: Bloomberg, JP Morgan. Data as of December 29, 2017.) | (+ = appreciation) (Source: Bloomberg. Data as of December 29, |

The full version of the article can be downloaded here.

Diesen Beitrag teilen: