NN IP: Reflation tailwind

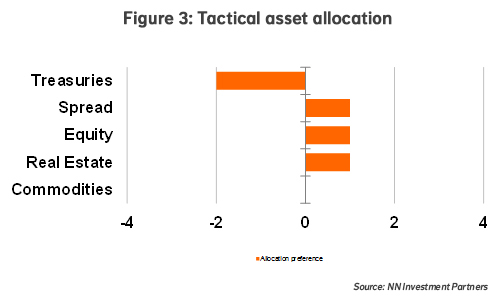

As the reflation theme gains traction and the behavioural component improves, we upgrade equities to a small overweight. Our current allocation combines growth and income.

09.10.2017 | 09:05 Uhr

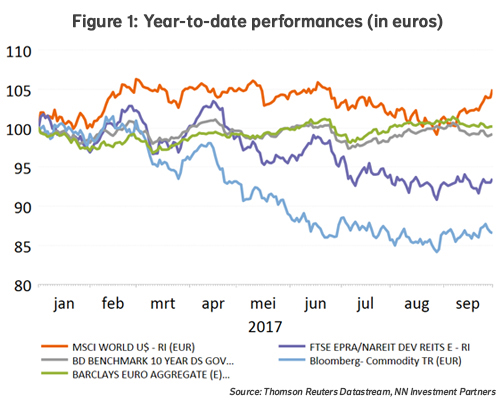

The reflation trade gained further traction supported by an improvement of the macro data, and also by somewhat higher bond yields as rumours about one of Yellen’s potential successors sparked some nervousness in the bond market. Equities were the best performing asset class, gaining more than 2% over the week. Some weakness in the euro was also helpful. Politics played an important role with difficult negotiations ahead in Germany, the chaotic Catalonian referendum and hope of a US tax plan. In the meantime, the war of words between the US and North Korea seems to have cooled down a bit.

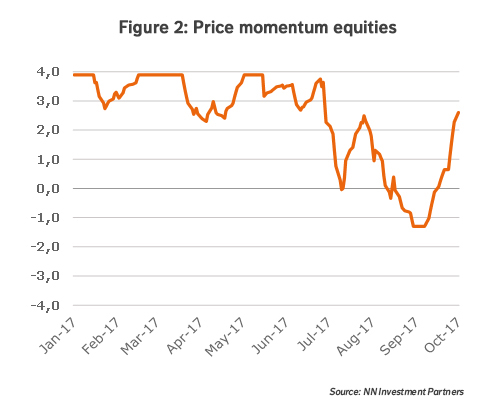

Our scorecard provides a mixed picture when we compare the fundamental drivers, which continue to give positive signals, with the more behavioural dynamics, which indicate more caution.

As Figure 2 illustrates, however, we observed in the past week some improvement in the market dynamics, driven by momentum and/or sentiment. As a consequence we decided to upgrade equities from neutral to a small overweight.

We currently have a medium underweight Treasuries and small overweights in equities, real estate and fixed income spreads. This allocation combines exposure to the reflation trade with exposure to the search for yield.

Diesen Beitrag teilen: