Robeco: Will the ECB dial down its support early?

Bond markets in Europe performed well in the periphery. In Spain the governments budget plans were broadly accepted by the EU, while Italy still struggels to set up an austere Budget.

27.11.2017 | 12:10 Uhr

Main market events

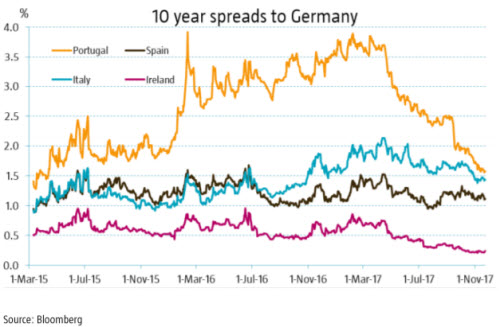

Peripheral bond markets performed well this week. The risk-on mood in markets was supported by rather spectacular business confidence and PMI prints. The minutes of the last ECB meeting published this week suggest some disagreement among Governing Council members regarding the end of QE. The French Executive Board member Coeure is now in favor of ending the asset purchases by September 2018; he said in an interview he hopes the October QE extension was the last one. By contrast in October Draghi hinted at a further extension. Italian bonds have returned 2.29% this year, Spanish bonds 1.61%, Portuguese bonds 13.26% and Irish bonds 1.13%.

Italy

This week, in its assessment of the Italian 2018 Budget Draft, the European Commission pointed to a significant risk of deviation from the fiscal targets in 2017 and 2018. Especially, the structural deficit reduction was gauged as insufficient to comply with EU rules. But it said it will review the compliance with the debt rule in spring 2018 with the new government. In the meantime, it is very unlikely that the current government acts upon the European recommendation and proposes a more austere budget. On the political front, the ruling PD party continues losing in voting intentions. Those votes are more likely to be transferred to the biggest single party – the 5 Star movement – rather than the centre-right.

Spain

PM Rajoy this week cools prospects of both a broad constitutional reform and a new fiscal pact between Catalonia and Spain. He stressed that the only way to solve the Catalan challenge is a strict adherence to the constitutional framework by the pro-independence forces, adding that Catalonia’s independence was largely opposed in the rest of the country. Meanwhile, there has been some shift in the position of the pro-independence parties, away from unilaterally exiting Spain towards a more constructive attitude to find some deal with Madrid.

The European Commission was rather complacent with Spain, stating that the fiscal plan presented by the Spanish authorities was “broadly compliant” with the EU requirements. The government had to extend this year’s budget into 2018 due to the political strains in Catalonia.

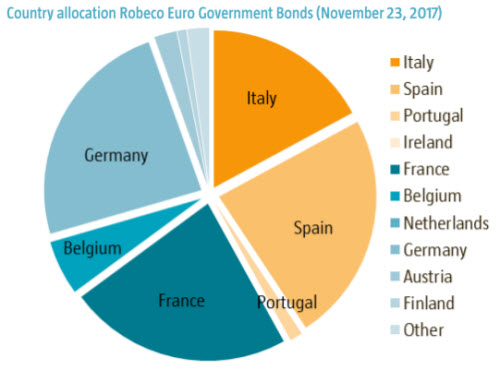

Robeco Euro Government Bonds

We maintained our positions in periphery this week: we have an overweight position in Spain, a small overweight in Portuguese government bonds and a small underweight position in Italian government bonds. We are positive on Spanish fundamentals. We remain wary of the political risks in Italy, but for now the ongoing ECB buying and the improving economic backdrop support all peripheral bonds. We hold no Irish bonds as their spreads over France do not compensate for the potential risks stemming from Brexit, international tax reform and the volatility inherent to Ireland’s size. On net, the fund remains overweight peripheral bonds, concentrated in Spain. Currently the fund is 42% invested in peripheral bonds compared to 40% in the index. Year-to-date the fund’s absolute return is 0.99%*.

* Robeco Euro Government Bonds, gross of fees, based on Net Asset Value, November 23, 2017. The value of your investments may fluctuate. Past results are no guarantee of future performance.

Diesen Beitrag teilen: