Schroders: 2015 a good year for convertible bonds

The equity market is likely to be the main driver of convertibles in 2015, when diligent research will once again be crucial.

26.11.2014 | 12:40 Uhr

Following the return of volatility to equity markets from the summer of 2014 onwards, only two things could soothe the nerves of the Schroders convertible bond team in Zurich: good convertibles and Swiss chocolate. Fortunately we had both in abundance. Now, with attractive valuations and demand remaining strong, what lies ahead for the hybrid asset class? First we need to consider the macro-economic situation.

ECB lagging in liquidity race

Compared to previous recoveries, the current economic improvement from the 2008 recession is still slow and will need longer than usual. Recent US growth data show the diverging trend between the US and Europe, as the Federal Reserve’s (Fed) quantitative easing (QE) clearly caused the US economy to accelerate at a far greater pace than the eurozone. QE drew to a close in the US – at least for the time being – in October 2014.

Elsewhere, we think that the European Central Bank (ECB) will need to pick up the liquidity baton and up its pace in the liquidity race. The Bank of Japan surprised markets on the final trading day in October, with an announcement of vastly increased-asset purchases. At the same, the lower yen will continue to give the Fed yet another good reason to delay introducing any tightening policy.

With the ECB lagging behind in the liquidity race, it has started its Asset Backed Securities purchase programme, but still needs to do more to fulfill Mario Draghi’s Jackson Hole promise of doing even more of ‘whatever it takes’. The low eurozone inflation figures, paired with historic low yields for German bunds, evokes the ghost of ‘Japanisation’. The eurozone needs more than a weaker euro to bring the economy back onto a sustainable growth path. We expect further supportive monetary policy from the central banks in 2015.

We will start the New Year with a clear overweight to equity exposure. A healthy bias towards US IT and biotech will help us to participate from continuing pace of the US economy. At the same time, we have little-to-no exposure to the energy sector.

Equities to guide convertibles

The main driver of performance for convertible bonds in 2015 will be the equity market. Due to the attached conversion right – which offers investors the chance to switch the bond into equity – a strong equity market is good news for investors in convertibles. However, as a hybrid strategy which combines equity and bond features, convertibles retain a degree of capital protection, which makes them attractive for fixed income investors. Given that both credit and sovereign yields have fallen to historic lows, the potential for investors to retain bond-like qualities while potentially benefiting from supportive equity markets can make convertibles a compelling opportunity.

The convertible bond market is niche; it is characterized by high investor demand but can suffer from periodic patches of low new issuance. This can have a significant effect on convertible valuations in certain segments of the market. At a regional level, convertible bond market characteristics can also vary widely. Being aware of these differences is integral to generating outperformance. The US convertible market is by far the biggest, most efficient and over the long-run, the most fairly-priced. At the other end of the spectrum, Asia is the smallest, least-liquid and on average comes with the highest credit exposure.

Attractive valuations

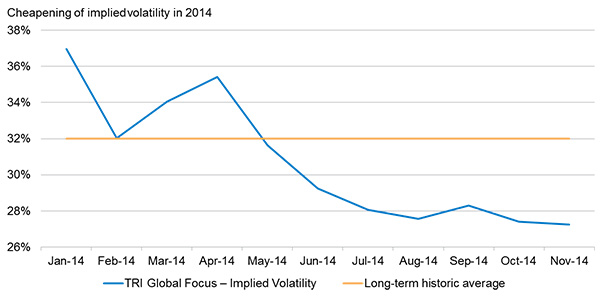

To invest successfully in convertibles, therefore, diligent internal research is crucial. Modelling conversion rights and detecting cheapness of convertible bonds is part of our daily work. We will start 2015 with a slight undervaluation of convertible bonds. Implied volatility, the main measure of quantifying convertible value, stands at under 30%, which gives investors a cheap access right to long-running equity market participation. Generally such a backdrop can be a good time to invest in convertibles.

Source: Schroders, Nov 2014

Active primary market

The primary market in 2014 was very active, and we saw an increasing universe of outstanding convertible bonds. At Schroders we believe we have the necessary market weight to be an active player in the primary market. With long-term rates in the US starting to rise, we forecast a solid new issue market for 2015. Within the large and most effective US market we expect further growth companies from IT and healthcare coming to the market. We are carefully aware that the equity market rally and the extreme tightening of credit spreads will attract all sorts of companies to come to the market. Hence, 2015 will be a year where bond selection will be crucial.

Volatility to prevail

Despite all the market noise created by geopolitics from Ukraine to Iraq, we feel that investors can retain a risk-on bias. We expect equity markets to remain supportive for the start of 2015. In contrast to the start of 2014 when volatility had been low – even too low – we believe that more volatile market conditions will prevail. This should not upset investors after a long rally. In fact, we think that stockmarket setbacks are a healthy part of a long-running bull market and that convertible bonds offer a compelling risk-reward profile. Convertible bond valuations, which have recently fallen, mean that convertibles are fairly priced for the asymmetric return profile they offer (i.e. they maximise upside potential while capping downside risk). The strategic growth tilt, participation in the equity market via a long term option, paired with strong credit selection, provides investors with a good mix of equity exposure and safety.

Diesen Beitrag teilen: