Schroders: A game of chicken in the oil market

Our multi-asset team provides its insights on current market trends and latest asset allocation views.

05.01.2015 | 16:50 Uhr

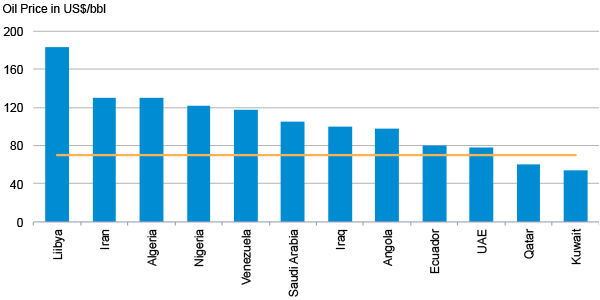

The recent sharp falls in the oil price reflect OPEC putting the squeeze on non-OPEC producers (primarily shale oil), to see who will blink first. At US$60-70 per barrel, the current oil price is below many OPEC producers’ breakeven price.

Figure 1: OPEC fiscal breakeven for 2015

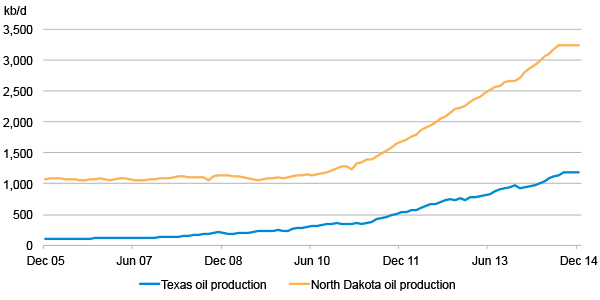

There has, however, been substantial oversupply of shale oil production in North America. Our expectation is that shale oil producers will be forced to cut capital expenditure as their revenues decline.

Figure 2 : Oil production growth in Texas and North Dakota

Shale oil wells are considerably different in nature to conventional wells. Their annual decline rate is much higher at 70-90%, compared to traditional wells at 3-5%. This means that any decline in capital expenditure will quicky be felt in oil supply.

Shale oil as the swing producer has changed the oil market from one which experienced long periods of boom and bust, to one which can rebalance itself fairly quickly. We therefore expect price stabilisation and possibly even a rebound over the medium term. However, this will not be before many shale oil producers experience severe financial difficulties.

Given the high weight of energy in the US high yield sector, we have downgraded our view on US high yield bonds.

Ignore the dollar at your peril

Given the recent strength of the US dollar, investors may wonder what to do in their portfolios. The obvious answer is to have long US dollar exposure, and indeed the US dollar is our preferred currency exposure versus other G10 currencies.

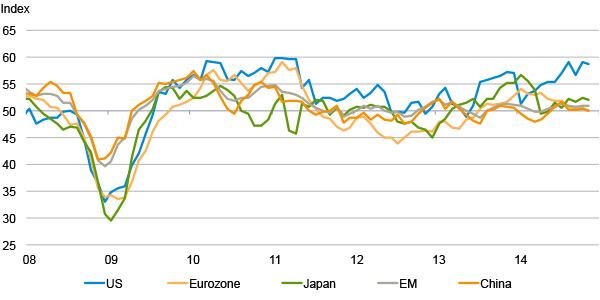

Economic data (e.g Figure 3, below) continues to show divergence between the US and other major economies, with the US continually raising the bar. The Fed is likely to raise rates later in 2015, and other supportive factors exist such as the renewed housing market recovery and shrinking current account deficit.

Figure 3: US leads the pack (manufacturing PMIs)

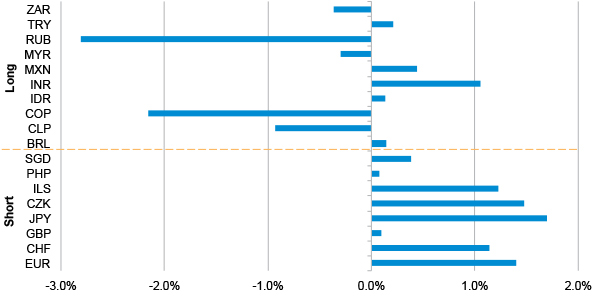

However, some investors invest in currencies to earn carry (yield), by going long high-yielding currencies and short low-yielding currencies. In this case the short side of the trade will often have short US dollar exposure, as the yield on dollar deposits is low. We recommend that these ‘carry-seeking’ investors diversify the short side of the trade across a basket of G10 currencies, including for example Japanese yen and euro. Having more diversified short exposure, or funding currencies, would have improved carry trade performance in the recent bout of dollar strength.

Figure 4: Performance contributions of basket of long high-yielding, short low-yielding currencies

Diesen Beitrag teilen: