Schroders: Attractively valued UK-equities

UK equities look attractively valued as an asset class and we believe that a backdrop of moderate growth, low interest rates and subdued inflation should allow further upward progress to be made in the year ahead.

12.12.2014 | 11:08 Uhr

However, a combination of patchy global growth and elevated indebtedness means the business cycle, and in particular peak economic growth levels, will be shallower than in the past. Periods of slower growth, as we have seen lately, will be met with concern on the part of investors and policy makers anxious about a return to recession and financial stress.

Nonetheless, despite this potential volatility, we believe that the potential for a recovery in capital investment and a likely increase in takeover activity are supportive, while the fall in the oil price should provide a fillip to economic growth. UK equity investors in particular could stand to benefit in the meantime from a prospective dividend yield of 3.8% and dividend growth of 6-8%.

Deflation fears overdone

Supportive monetary policy, with analysts and investors expecting continued policy intervention in the eurozone and Japan, should help to stave off deflation. Indeed the deflationary fears have driven ‘gilt proxies’ (such as many of the utility companies found within Value Defensives, one of the seven style groupings followed by the Business Cycle equity team - see below) and they are now fully valued for their expected earnings growth and in the main we have limited exposure to this area.

Instead, we are seeking out those Value Defensive and Growth Defensive stocks with lower ratings and resilient earnings such as telecoms and pharmaceuticals. Elsewhere in our portfolios, we see value within the Financials style grouping including on a selective basis the UK banking sector where we see positive signs of a recovery in the regulatory capital position and an improved focus on core activities and hence ultimately a recovery in shareholder returns as well. The recent weakness in Commodity Cyclicals amid falling oil and metals prices should encourage a renewed focus by management teams on reducing capital investment and improving returns on equity and we continue to monitor these developments carefully.

Low-growth world

We entered 2014 feeling that it would be a year where the business cycle would start to mature and where economic growth would moderate from prevailing high levels. This has turned out to be the case with somewhat patchy economic progress being made throughout the year.

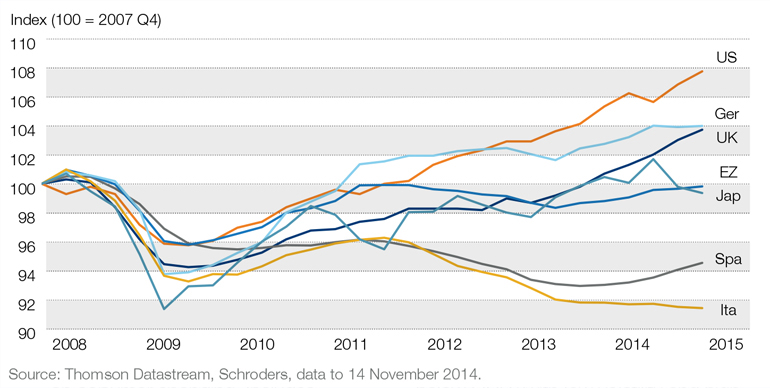

In the US and UK, economic performance has been decent with investors now looking ahead to an eventual normalisation of monetary policy. In contrast, the eurozone, Japan and China have experienced growth headwinds (see above). We expect this divergence between the world’s largest economies to continue in the short term.

However, as the Federal Reserve looks to start raising rates at a time when eurozone and Japanese policymakers remain highly accommodative, the gap in GDP growth may well start to narrow. We remain of the view that stubbornly high levels of debt in the system will make for subdued global economic growth in the medium term.

The maturing of the business cycle continues to make us cautious of those early cycle stocks where margins have recovered and where valuations are full. We have already reduced exposure to the Consumer Cyclical and Industrial Cyclical style groupings which served us well when we came out of the 2008-2009 financial crisis.

Diesen Beitrag teilen: