Schroders: Mixed picture for global equities in 2015

We see 2015 as being characterised by an ongoing divergence in global growth and monetary policy that will create attractive pockets of investment opportunity for stockpickers.

01.12.2014 | 12:57 Uhr

Global equities are likely to paint a mixed picture in 2015, with the extent of economic recovery diverging across regions. While fundamentals remain positive in the US which should help to drive global growth in 2015, uncertainty lingers in Europe, Japan and most of the emerging markets.

Overall, analysts’ expectations currently reflect a lower growth environment in 2015. We believe there could be positive surprises at both the aggregate level regarding global growth and strategic inflows into equities from large asset owners globally, and from a bottom-up stock perspective, albeit in an environment of heightened volatility. We continue to find an abundance of compelling opportunities as we discuss below.

A buoyant US consumer

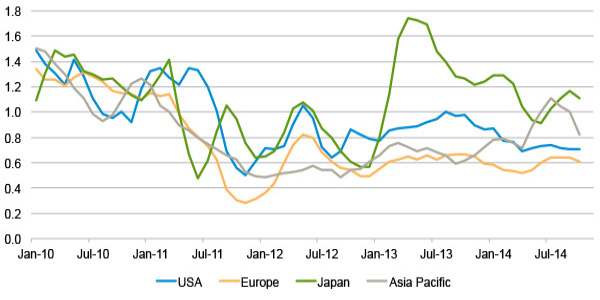

The US equity market performed well in 2014, with the S&P 500 breaking a number of record highs over the year. In an environment of improving economic growth, companies have been performing well and generating strong earnings growth. We are, however, starting to see earnings momentum slow (see Figure 1) as companies struggle to maintain levels of strong growth seen over the last couple of years. Market consensus still expects high double-digit earnings growth in 2015, which may be a challenge given a slower growth backdrop and pressure on margins.

Figure 1: Trends in earnings expectations by region

Source: BofA Merrill Lynch Global Quantitative Strategy, MSCI, IBES. As at 31 October 2014.

However, there are areas which could potentially surprise market expectations to the upside. Discretionary consumption has generally fallen short of expectations in an environment of subdued real income growth and efforts to restore personal balance sheets. However, a tighter jobs market and ongoing weakness in the oil price, amongst other things, boosts consumer purchasing power and should contribute to the potential for an acceleration in discretionary spending. With improving employment prospects and more money to spend, we expect to see US discretionary spending as a percentage of disposal income rise, to the benefit of durables- and luxury goods-related companies. We are finding some interesting ideas in this space, particularly amongst the auto-related companies which we believe are likely to gain from a stronger consumer as well as the trend towards greater connectivity and automation in the industry.

It is worth mentioning that we do not expect the consumption recovery story to be derailed by potential interest rates hikes in 2015. Rate rises will likely prompt some volatility, but ultimately we believe the Federal Reserve will ease into a tightening phase slower than many in the marketplace currently expect and that consumption will be robust enough to withstand this.

Tailwinds for some European and Japanese companies

In contrast to the improvement seen in the US, European and Japanese economic growth has slowed and policy measures implemented to support growth have resulted in weaker currencies. This is good news for companies with a global footprint as they are likely to enjoy a boost to earnings and increased competitiveness in the global marketplace.

We are more constructive about Japanese equities relative to the European market. Japanese Prime Minister Abe’s recent decision to delay the second consumption tax increase will be supportive for the economy and for domestic equity buyers while improved corporate governance is likely to attract more foreign equity buyers. Furthermore, corporate tax cuts over the next few years will boost companies’ earnings. In Europe, companies have managed to post good results but this has largely been on the back of extensive cost-cutting measures while actual revenue growth has been negligible. But overall, the softer European economy is likely to weigh on the market in 2015 and curtail the ability of European companies to generate meaningful earnings growth.

Emerging markets: India the only bright spot

The emerging markets are a concern and our earnings outlook for three of the four BRICs is negative. India is the only bright spot in our view: it has an exciting investment story, with exceptional demographics and a vibrant private sector. Although the economy and the market have both done well in 2014, we think they have further to go. The new government’s policy initiatives are encouraging and should benefit domestically-orientated companies, particularly those with exposure to fixed capital formation and financial services. The Indian consumer should also receive a welcome boost from lower energy prices and reduced inflationary pressure.

Diverging global growth creates opportunities

There remain, of course, a number of geopolitical risks that could emerge (or re-emerge as the case may be) during the year. We expect this, along with the divergence of global growth and monetary policy action to generate some volatility in 2015. It may not be an easy ride for equities, but we believe this divergence will also create attractive pockets of investment opportunity, to the benefit of stockpickers, and see plenty of scope for earnings surprises in 2015.

Diesen Beitrag teilen: