Schroders: Multi-Asset Insights: US small caps – time to take profit?

Our multi-asset team provides its insights on current market trends and latest asset allocation views.

24.10.2014 | 15:03 Uhr

In April we downgraded our view on US small caps to negative, based on a valuation which was extremely stretched. Since then, even though we have seen significant underperformance of this market, valuations remain stretched.

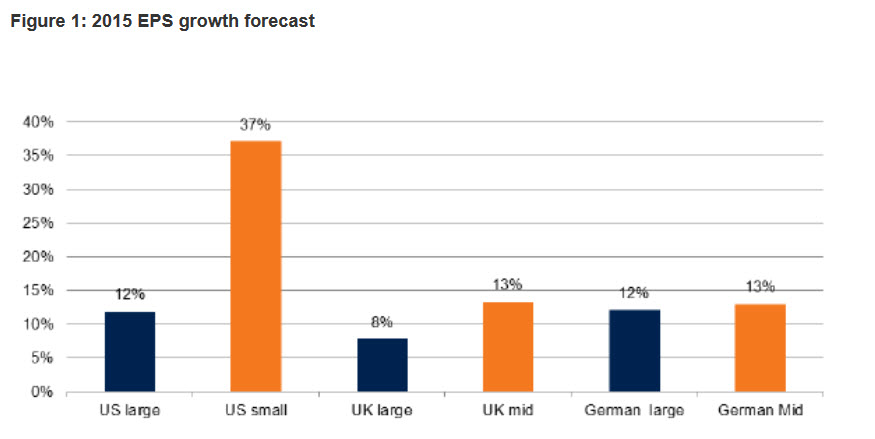

Aside from valuation, there are other factors that support our negative position. Figure 1 below shows that investors are overly optimistic with regards to US expectations of earnings growth for small caps relative both to large caps and to other small cap markets.

Source: Datastream, as of September 30, 2014. The data includes some forecasted views. We believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. There is no guarantee that any forecasts or opinions will be realized. Sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell.

Furthermore, smaller companies have been the primary beneficiaries of the excess liquidity provided by central banks. While the impact of tighter credit conditions has not been consistent over history, Figure 2 highlights that, unlike their large counterparts, smaller companies have not taken advantage of the low cost of debt to de-lever their balance sheets. This suggests that small caps are more exposed to a tightening in liquidity conditions than was the case in previous cycles.

Diesen Beitrag teilen: