Morgan Stanley IM: Equity Market Commentary - September 2023

Takeaways & Key Expectations

Marktkommentar

In his September TAKE, Senior Portfolio Manager Andrew Slimmon presents thoughts about what could be ahead for equities as the market heads into the last quarter of the year.

18.09.2023 | 07:52 Uhr

Thoughts as we approach year-end.

If you are receiving this directly, thank you. That means you have invested in either our SMAs or mutual funds.

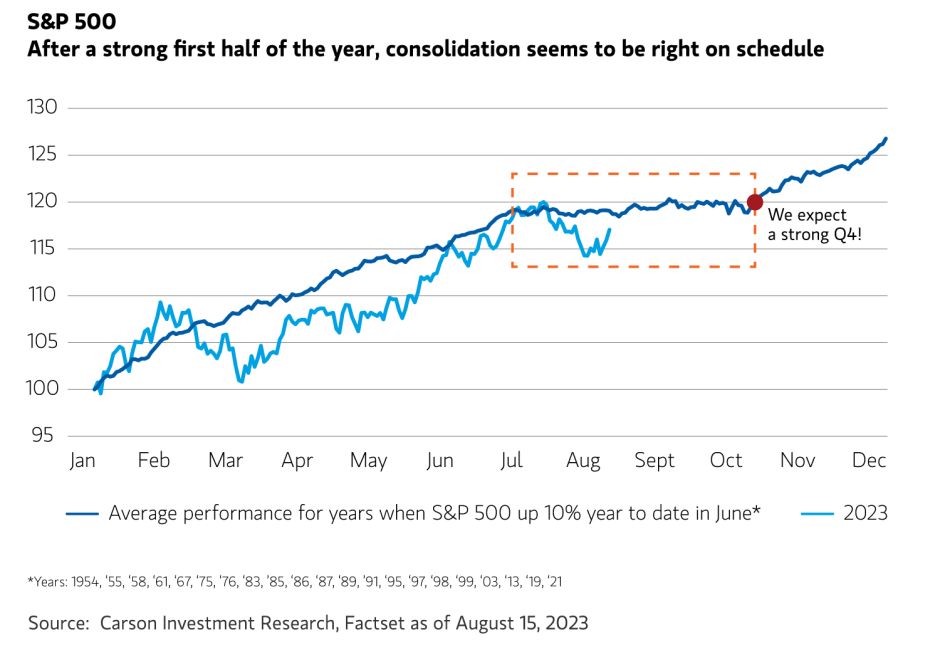

- I still think September is acting as it seasonally does. I don’t see much progress this month if oil, interest rates and the dollar remain strong. However, I do expect a Q4 rally will cause the market to end the year closer to 5,000.

10486567-Display-1_v6.jpg

Diesen Beitrag teilen: