Morgan Stanley IM: The Most Contrarian Outcome - No Landing

Given a strong consensus for a Soft Landing and lingering Recession fears, No Landing would be the most contrarian scenario for markets.

23.10.2024 | 05:45 Uhr

In fact, there are some hints that the dichotomy between strong spending and weak labor markets could resolve in favor of No Landing. Rates and some segments of the equity markets have overpriced a Soft Landing and would be vulnerable in this scenario.

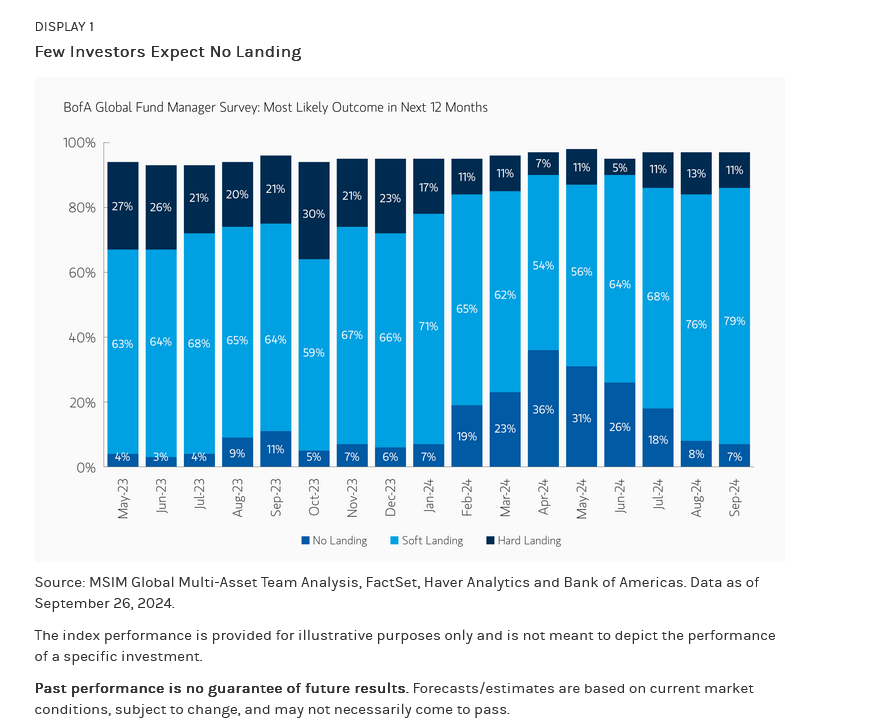

Recession risks have been top of mind since early 20221 when headline inflation reached 9%, the Fed hiked 525 basis points (bps) in 18 months (the steepest pace in 40 years) and the yield curve inverted by more than 100 bps. Such steep inversion has been a precursor to recession in the following year every time in the past six decades. But the U.S. economy exceeded the consensus and our expectations in late 2022, 2023 and the first half of 2024, averaging 2.3% annual growth. Despite this, today the overwhelming majority of investors (79%) still expect a Soft Landing (i.e. sub-trend growth) in the next year, and 11% expect Recession (Display 1).2 In fact, the most contrarian outcome for markets would be No Landing (i.e. above trend growth).

Recently, cautiousness on the economy has been driven by weakening labor market data, but households are consuming and businesses are investing.3 The consensus will likely face another positive surprise in Q3 with GDP likely to hit 3% vs 2% currently expected.4 And there are some indications that the dichotomy between a weak labor market and strong spending could resolve in favor of the latter:

Diesen Beitrag teilen: