Henderson: Miners’ discipline brightens global natural resources outlook

David Whitten, Head of Henderson’s Global Natural Resources Team, is encouraged by early moves by major mining players to lift returns across the diversified resources sector and sees a renewed focus on long life, low cost, high return assets.

05.04.2017 | 14:08 Uhr

(Foto: David Whitten, Executive Chairman)

In response to the downturn following the mining boom from 2003 to 2007, the world’s largest mining companies are overhauling their policies, applying more discipline and focus to their capital expenditure and rationalising asset portfolios. This shift will ultimately leave these companies in a far better shape to capitalise on any opportunities that present themselves, while increasing their stability and resilience to better weather future downturns.

A sensible shift in dividend policies

The period between 2011 and 2016 was not kind to diversified resource investors – peak capital expenditure took place at the same time as peak earnings and peak debt. Direct shareholder returns were restricted by the so-called ‘progressive dividend’ policy set by BHP Billiton and Rio Tinto such that the dividend would either be regularly increased or, at the minimum, maintained.

This ‘progressive dividend’ policy meant that in times of peak earnings, dividend payout ratios (percentage of earnings distributed to shareholders in the form of dividends in a year) were low, sometimes less than 15%. However, in periods of weak earnings, dividend payouts were in excess of 100%, when the companies could least afford it. For the first time in decades these two mining leaders have acknowledged the cyclical nature of their businesses and changed their dividend policies.

We are only beginning to see the impacts of these changes as a quicker-than-expected turnaround in profitability, further assisted by higher commodity prices, which bottomed in early 2016, has enabled the sector to act on its intent.

Recently announced dividend policy changes include:

• Rio Tinto’s payment of a dividend at the top of its payout range of 40-60% and its announcement of a US$500m share buyback that takes the full payout to 70%;

• BHP Billiton setting its interim dividend in line with a promise to pay 50% of underlying earnings along with a 'top up' payment, which added US$0.10 per share, taking the total payout to 60%;

• Glencore defining an innovative policy set around the reliability of earnings from its marketing division from which it will pay US$1.0bn p.a. with the balance of the dividend sourced from the mining business at a rate of 25% of free cash flow.

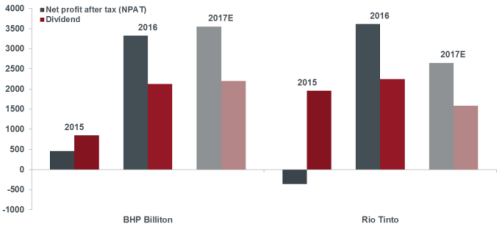

Other miners appear to be following suit. Anglo American is set to update its policy in mid-2017. The chart below shows the year-on-year second half net profits and dividends for BHP Biliton and Rio Tinto, highlighting the improving profit rebound and the shift in dividend policy

Second half dividend and net profit in millions of US$

Source: Bloomberg and Henderson Global Investors at 28 February 2017. 2017E = Bloomberg and Henderson Global Investors estimates.

Commitment to capital discipline

The Global Natural Resources Team is particularly positive about the capital discipline of these four mining giants in restricting capital to maintain their assets that are in the best of health and limiting new capital expenditure to the highest returning opportunities. We concur with the learnings of BHP Billiton and Rio Tinto that embarking again on multiple large-scale projects simultaneously is no longer a sound business strategy. Jean-Sébastien Jacques, CEO of Rio Tinto, commented that “never again will we be spending US$18bn in a year”. The four diversified companies are now collectively spending capital at a rate of US$17bn p.a. compared with almost US$55bn at its peak in 2012. Shareholders look set to benefit from the massive capital spend between 2006 and 2012 to meet growing mineral demand from China. Maintenance capital is expected to be well below depreciation levels, which should boost free cash flow. At the same time, debt, which rose to uncomfortable levels during the peak investment phase, is being rapidly unwound. All four companies are targeting lower absolute debt levels in view of the changing geopolitical risk brought about by Brexit, the trade implications from the election of Donald Trump and uncertainties around the longevity of China’s economic stimulus.

Simplified portfolios through asset sales Each of the four companies discussed have undergone a process of simplifying and streamlining their asset portfolios to enhance business efficiency and focus on core, high– returning assets:

• Rio Tinto’s asset sales are likely to continue as it simplifies its portfolio and lives up to its commitment to invest in only the highest returning assets;

• Anglo American has committed to holding on to its coking coal and iron ore assets given the resolution of its debt problems;

• BHP Billiton has simplified its portfolio via the spin-off of non-core assets into South 32 (a base metal and mining company);

• Glencore has reduced its debt through a successful asset sale programme and is now making smaller opportunistic acquisitions in copper and is considering consolidation in the North American agriculture sector.

The message we take from this is that although large scale corporate transactions are off the agenda there may be room for bolt-on opportunities.

The upshot of stronger-than-expected cash flows, restrictions to capital expenditure budgets over the next three years and normalised debt levels (in most cases by the middle of this year), is that shareholders stand to benefit from a surge in cash returns and share buybacks. The magnitude of returns are likely to accelerate through the 2017 calendar year, especially given that commodity prices have begun the year well above analyst estimates.

Can the leopard really change its spots?

We believe at the very minimum, over the next two to three years, investors can expect high cash returns as these four major mining companies finally benefit from the heavy investments over the last decade. However, there is a good chance that the sector has learned from the over-enthusiasm of the past, with new productivity initiatives replacing spending on new mining projects. All four companies now have fewer but higher–returning growth options (copper, bauxite, oil and gas) and debt levels are now modest to low. The stage is indeed set for a reinvigorated sector focused on long–life, low–cost, high–return assets where the shareholder no longer has to rely purely on capital gains, but can also expect enhanced dividend income and capital returns.

Note: references made to individual securities are for illustrative purposes only and should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Diesen Beitrag teilen: