Schroders: Why investors are poring over water losses

Climate change is putting additional strain on water infrastructures, but opportunities are springing up as a result.

31.08.2017 | 07:54 Uhr

Climate change is affecting regional weather patterns, and the associated rise in extreme temperatures is putting pressure on the water infrastructure sector to reduce treated water losses from current levels - a staggering 30%.

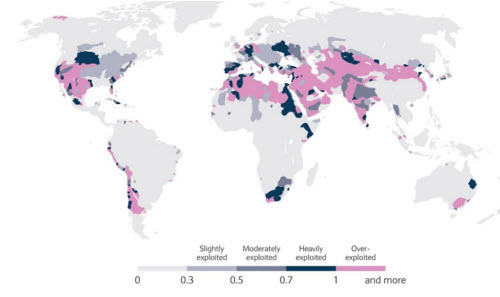

Water stress in major basinswater

Source: Philippe Rekacewicz, GRID-Arendal/Barclays, March 2017

In some areas of the US, water and wastewater infrastructure systems have been in place for over a century. But this isn’t unique in developed markets. Global Water Intelligence has noted that North American and European economies built the bulk of their water networks in 1950, which means we are approaching a useful life of 70 years. The age of these systems means replacement demand for pipes, pumps and water plants – as they reach the end of their expected lives – looks set to rise.

The Environmental Protection Agency (EPA) estimates that if water infrastructure investment remains at current levels, the funding gap for the years 2000 through to 2019, could reach $270 billion for wastewater infrastructure and $263 billion for drinking water infrastructure1. Investment in water infrastructure is necessary to prevent disruptions in water service. Many places across the US have already experienced the consequences of major service disruptions due to an aging water infrastructure. We have seen estimates that indicate these water service disruptions put $43.5 billion in daily economic activity at risk.

We can also expect water infrastructure investment in developed markets to grow due to innovation. As more customers understand the benefits of new technologies - such as intelligent water pumps, leak detection technologies, smart water meters and associated secure networks2;with data analytics - the ideas should gain traction.

In emerging counties, there is a continuing need to develop water infrastructure from a low level. We expect the market here to grow even faster. China has one fifth of the world’s population, but just 7% of global water resources. Freshwater supply in China is less than one-third of the world average. China’s Ministry of Environmental Protection estimates that it will spend $230 billion for water treatment and related services over the next five years. Over 70% of the world's new water infrastructure will be built in the emerging markets regions.

Water infrastructure is a secular theme that is directly impacted by climate change. It is also an important contributor to climate change. A significant amount of utilities’ greenhouse gas usage is tied to water management.

Die hierin geäußerten Ansichten und Meinungen stellen nicht notwendigerweise die in anderen Mitteilungen, Strategien oder Fonds von Schroders oder anderen Marktteilnehmern ausgedrückten oder aufgeführten Ansichten dar.

Der Beitrag wurde am 30.08.17 auch auf schroders.com veröffentlicht.

Diesen Beitrag teilen: