Morgan Stanley IM: Growth vs. Value: Interest Rates as a Driver of Style-Relative Performance

The Portfolio Solutions Group offers their perspective on interest-rate shifts as a driver of both performance and valuation differentials between Growth and Value equity styles.

26.10.2022 | 06:56 Uhr

Here you can find the complete article

In this paper, we offer our perspectives on interest-rate shifts as a driver of both performance and valuation differentials between Growth and Value equity styles, particularly over the last 15 years. We focus on fundamental drivers that specifically interact with interest rates and have significant implications for valuation.

In explaining the link between Growth vs. Value performance and interest rates, market commentary has tended to focus primarily on differences in the distribution of cash flow over time. Growth stocks have projected cash flows weighted further in the future, and thus are more sensitive to changes in discount rates compared to value stocks. We view this dynamic as accurate and important, but likely incomplete on its own.

We believe a company’s competitive dynamics and barriers to entry are other factors influencing a stock’s valuation and sensitivity to changes in interest rates over time. We further posit that Growth indexes are more likely to include companies with higher barriers to entry vs. Value indexes—at least when considering the last 15 years. Taken together, this suggests additional mechanisms may drive Growth’s higher valuation sensitivity to changes in interest rates as compared to Value.

We see three reasons why exploring these Growth vs. Value valuation dynamics may be beneficial for investors:

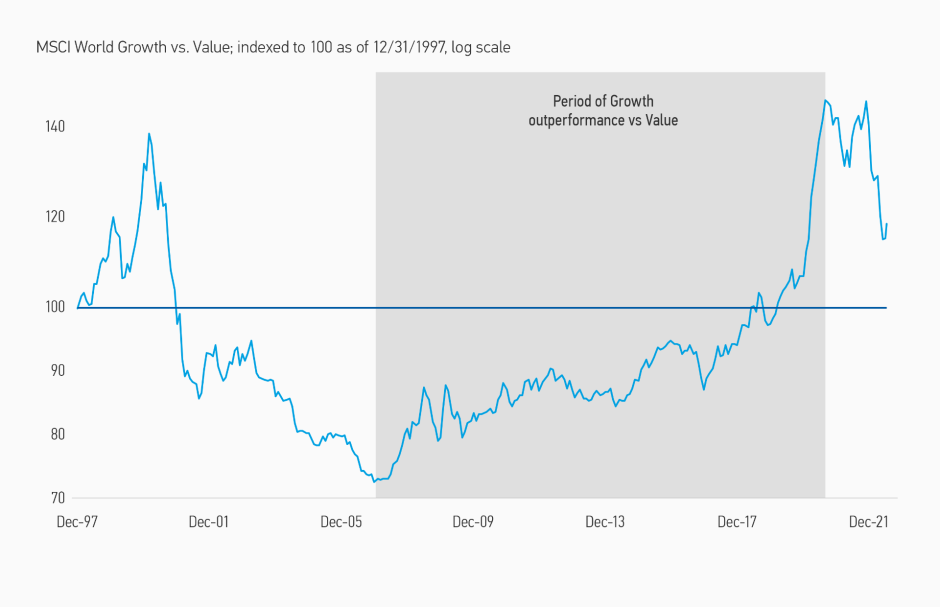

- Offers a more complete explanation of the past 15-year performance gap: The performance and valuation gap between Growth and Value over the last 15 years in the context of falling interest rates has been extreme (Displays 1 and 2). These gaps have only partially reset as interest rates have moved higher. This period of Growth outperformance can be more easily understood when integrating mechanisms related to differing competitive dynamics.

- Exposes factors that may impact future performance differentials: Apart from understanding past dynamics affecting Growth vs. Value performance, we believe our framework can be useful in understanding potential future trajectories/ complexities. Rather than a purely mechanical relationship between shifting interest rates and stock valuations—we believe the experience of the past 15 years partly reflects an interaction between interest rates and competitive dynamics. Competitive dynamics are of course not static, but ever evolving. Functionally, as asset allocators, this means we cannot depend purely on a forecast of the path of interest rates and management of style exposures based on historical correlations. We also need to consider the insights from active equity managers around the interaction between evolving competitive dynamics and the shifting cost of capital.

- Points out links to other key thematic trends: A notable trend in recent years has been the rising concentration of top large-cap names within equity indexes driving returns; this is especially true for Growth indexes rather than Value indexes. Alongside concentration at the top, there has also been concern around weak productivity and market congestion at the bottom—an issue now most often encapsulated under the term "zombie companies". We believe both themes can be viewed as additional symptoms of the competitive dynamic differentials we believe play a role in mitigating valuation sensitivity to interest rates.

DISPLAY 1 A long period of Growth outperformance relative to Value

As of July 11, 2022

Source: Bloomberg, Morgan Stanley

DISPLAY 2 A widening valuation gap between Growth and Value

Preface

To avoid potential confusion, we offer some quick notes on the intended scope of this paper. When approaching the terms Growth and Value, our focus is on commonly used Growth and Value style indexes.

Additionally, it is not our intention to analyze or discuss all the various drivers of Growth vs. Value relative performance. Our focus is on interest rates as a driver of both performance and valuation differentials, and the fundamental drivers that specifically interact with interest rates with implications for valuation.

Deconstructing the Mechanics Linking Rates to Growth vs. Value Performance

In framing the Growth vs. Value trade in terms of interest-rate duration, the most common explanation focuses on how cash flows are distributed over time: Cash flows for growth stocks sit farther in the future, making the discounted value of Growth more sensitive than Value to changes in the discount rate. This explanation focuses specifically on how changes in the discount rate impact valuation for stocks with different growth trajectories. From a fundamentals perspective, however, we think there is another important factor to consider. We believe a company's competitive dynamics play a critical role in affecting the sensitivity of the stock's valuation to interest rates. In our view, layering this on top of the timing of cash-flow distributions provides a more complete explanation for the magnitude of performance and valuation disparities between Growth vs. Value over the last 15 years as interest rates declined.

ESTABLISHING THE LINK BETWEEN COMPETITIVE DYNAMICS AND INTEREST-RATE SENSITIVITY

A company's growth rate can be viewed as a function of the returns it can generate from allocating capital. While many factors play into those returns, over time competitive dynamics should constrain a company's returns relative to its cost of capital. Where excess returns are high and barriers to entry are low, new competitors will be drawn into the market. Over time, that additional competition will erode excess returns until the incentive for new entrants is eliminated. Since interest rates are a core driver of cost of capital, this means that falling interest rates might over time lead to lower returns on company investment, with the degree of sensitivity dictated by competitive dynamics. Company returns should be strongly linked to changes in cost of capital where barriers to entry are low (over a long enough time frame), or weakly linked where barriers to entry are high.

The relevance to Growth vs. Value comes from an assertion that Growth in aggregate tends toward higher barriers to entry than Value, or at least has over the last 15 years—we look to support this assertion more directly later in the paper. If this assertion holds, then companies in Growth indexes may be better able to sustain returns on capital with relative insensitivity to shifts in the cost of capital. Conversely for companies in Value indexes, a falling cost of capital over time might translate to lower returns on invested capital, as competitive dynamics keep returns in check.

If viewing valuation through the lens of discounted cash-flow valuation, the following implications might apply. If interest rates fall and drive relevant cost of capital lower, both Growth and Value would benefit from a lower discount rate. Growth would see significant benefit, both because base-level growth is higher (cash flows weighted further in the future) and growth rates may persist regardless of a lower cost of capital. Value would already see less valuation upside relative to Growth given a lower growth rate (cash flows more weighted toward the present). Moreover, valuation upside might be further reduced by a decline in cash flow growth (or, alternatively, require greater investment for the same level of growth) as competitive dynamics push company returns on capital toward the new, lower cost of capital.

DISCLAIMERS

The views and opinions are solely those of the author as of the date of publication, are subject to change at any time due to market or economic conditions, will not be updated or supplemented after the date hereof and may not necessarily come to pass. The views and opinions expressed herein do not reflect those of all investment personnel at Morgan Stanley Investment Management, Inc. (“MSIM”) or the views of the firm as a whole, and may not be reflected in all the strategies and products that the firm offers.

Certain statements herein are based upon the views and opinions of or data obtained from one or more third parties. While MSIM believes these statements to be an accurate summary of such views, opinions and/or data, MSIM has not independently verified their accuracy or completeness, or of any factual statements or other information forming the basis of or contained in any such views, opinions and/or data, and accordingly MSIM makes no representation or warranty, express or implied, with respect thereto. MSIM, its affiliates and its and their respective directors, officers, employees, members, general and limited partners, sponsors, trustees, managers, agents, advisors, representatives, heirs, successors and executors shall have no liability whatsoever in connection with any person’s or entity’s receipt, use of or reliance upon any information in this piece or in connection with any such information’s actual or purported accuracy, completeness, fairness, reliability or suitability.

All content herein is protected under copyright and other applicable laws, and may not be distributed or republished without the prior written authorization of MSIM.

This general communication, which is not impartial, is for informational and educational purposes only and not a recommendation, solicitation, offer or solicitation of an offer to buy or sell any securities or otherwise engage in any investment strategies. The information herein does not address financial objectives, situation or specific needs of individual investors.

Any charts and graphs provided are for illustrative purposes only. Any performance quoted represents past performance. Past performance does not guarantee future results. All investments involve risks, including the possible loss of principal.

Global Pandemics. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) that affect markets generally, as well as those that affect particular regions, countries, industries, companies or governments. It is difficult to predict when events may occur, the effects they may have (e.g. adversely affect the liquidity of the portfolio), and the duration of those effects.

Jetzt weiterlesen

Dieser Inhalt ist für professionelle Anleger bestimmt. Mit Klick auf "Weiter" bestätigen Sie, dass Sie ein professioneller Anleger sind und stimmen unserer Datenschutzerklärung zu.

Weiter

Diesen Beitrag teilen: