Morgan Stanley: Warning - Ice on the road ahead

European and US investors returned from their traditional summer holiday period to a market pullback, with the VIX spiking to highs of 38 after hovering throughout August around the low 20s.

15.09.2020 | 08:15 Uhr

Here you can find the complete article

The US led the decline as the S&P 500 fell 4.3% over two trading days during the first week of September and the NASDAQ was down 6.2%2 . There may have been an element of profit-taking driving the pullback after the huge rally markets experienced since the March sell-off.

We are concerned that despite the market rally we have experienced since March, as we already look ahead to winter, exuberant investors may in time hit ice, with the potential to skid off the road. As the economic impact of COVID-19 becomes clearer and, potentially, support from governments and central banks tails off, the key risk is that the momentum could be derailed. The pullback may be a warning sign that a long-anticipated correction is on its way, which could be significant in scale.

Despite the positive sentiment in parts of the market, we do not believe it is the right time to increase equity exposure. The opportunity to raise equity levels may present itself before the end of 2020, should a correction bring valuations and sentiment – which are currently extreme – back to more reasonable levels, but we are prepared to be patient, seeking to maintain portfolio volatility close to target levels.

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See Disclosure section for index definitions.

Tactical Positioning

Since our last note on 21 August, we have not made any changes to our broad asset mix. However, we continue to look for tactical opportunities and have made the following changes, which we discuss below:

German equities

We are relatively optimistic on EU growth given the following:

1. The manufacturing sector’s stronger relative growth prospects in the short-term should benefit the EU greatly, as the sector represents a larger proportion of the EU GDP relative to the US. The EU also has stronger consumer spending trends and welfare support than the US. Moreover, short-term work programmes in the EU are expected to be extended in 2020. In contrast, the US’s supplementary benefits expired at the end of July 2020, with Congress failing to agree on further stimulus before the August recess.

2. The agreement of the EU Recovery Plan in July 2020, with capital of EUR 750bn expected to be mobilised in early 2021 through to 20243.

3. National fiscal spending plans have already been announced in Germany (worth 9% of GDP over 2020-21) and France (4% of GDP for 2021-22)4.

Overall, eurozone GDP growth is expected to be higher than in the US for the next three quarters. However, within the EU, we expect Germany to emerge from the crisis the fastest, having suffered relatively less of a hit to growth compared with other EU economies, and is better placed to outperform during the recovery. For this reason on 20 August we moved from neutral to overweight German equities.

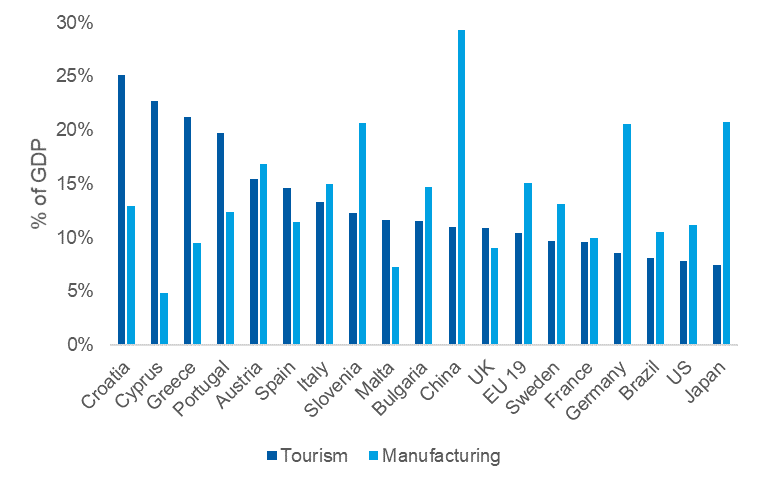

With respect to fundamentals, Germany has contained the pandemic outbreak relatively well and we believe is well placed to continue to outperform on this front, owing to both more hospital capacity and a more effective health policy response. Moreover, Germany’s economy has a high share of manufacturing relative to EU peers and conversely a lower share to those sectors most affected by containment measures, such us tourism. The periphery’s elevated exposure to tourism and the recent disruption to summer travel, suggest economies such as Italy and Spain will likely see another outsized hit to growth in Q3 2020. Germany has also announced and implemented sizeable fiscal support year-to-date. When looking at valuations, Germany’s attractive relative FY2 PE multiples and an under-allocation to the country by investors support the case for outperformance.

Germany’s manufacturing exposure is the highest among EMU countries and is currently benefitting from strong auto export demand

Source: OECD, World Bank, Datastream, MSIM. Data as of 1 September 2020.

However, there are a number of key risks to Germany’s recovery, the biggest of which is its reliance on external demand, which could be jeopardised by a hard Brexit, renewed trade tensions between the US and China and a slower global recovery due to persistent surges in COVID-19 cases across many US states. During the two-day pullback the DAX was down 3%5 however, this is a position which we believe should play out positively in the long term. Indeed, on the trading day following the pullback, the DAX partially recovered and was up 2%6.

Global renewable energy

On 20 August for portfolios that permit it, we added to our position in global renewable energy, which we first initiated on 20 July 2020. This was based on our continued conviction of this sector’s exposure to positive structural growth trends, which are increasingly being supported by both government policy and economic incentives to invest in clean energy.

1 Bloomberg, as of 4 September 2020.

2 Bloomberg, 3 and 4 September 2020.

3 EU Commission. www.ec.europa.eu/info/live-work-travel-eu/health/coronavirus-response/recovery-plan-europe_en

4 Source: GS, Europe on track for outperformance.

5 Bloomberg, over 3 and 4 September 2020.

6 Bloomberg, one day return, as of 7 September 2020.

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: