Schroders: The rise of China's technology giants

When little-known Chinese online gaming and messaging company Tencent decided to list in Hong Kong back in June 2004, its shares were offered at HK$ 3.70 apiece. Fast-forward 13 years to the present day, which has also taken in a 5-for-1 stock split, and Tencent shares are now trading at around HK$ 340. Although forming only one part of China’s famed technology triumvirate of Baidu, Alibaba and Tencent, popularly known as BAT, it is an apt illustration of the meteoric rise of China’s technology behemoths.

27.09.2017 | 15:39 Uhr

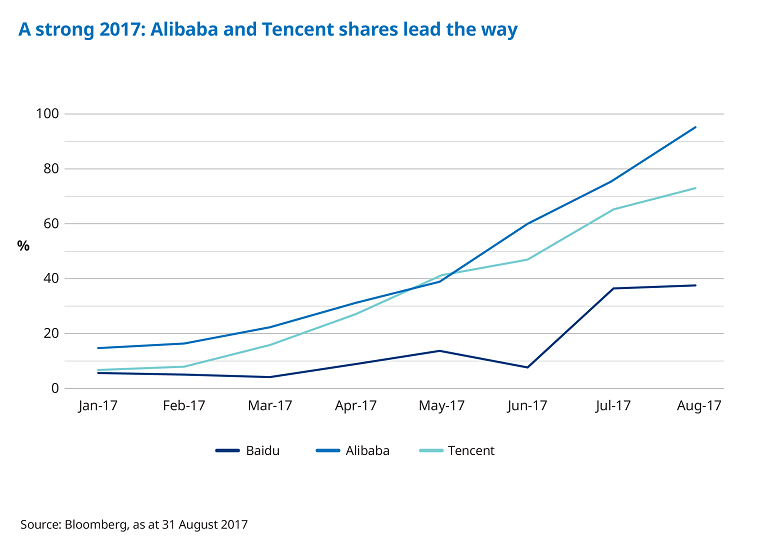

Alibaba, one of the world’s largest e-commerce companies, and Tencent, an online gaming company and WeChat operator (a messaging service which has over 900 million users), have left their smaller counterpart, Baidu, lagging in the last two to three years. This is partly due to Alibaba and Tencent’s success in expanding outside their core e-commerce and online gaming/messaging franchises into new growth areas like cloud computing, payments, advertising and video. Meanwhile Baidu, the country’s dominant search engine, and commonly referred to as “China’s Google”, has had far less success with its new business initiatives to date and was hard-hit by a medical advertising scandal.

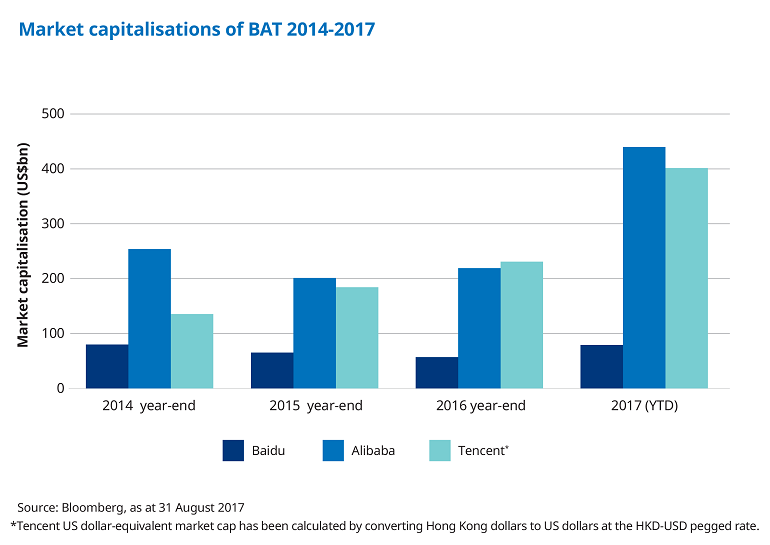

With the phenomenal performance of their shares in recent years these three companies have now achieved huge market capitalisations (see chart below) and are among the largest global, not just Chinese, listed companies. This strong growth reflects their dominant local franchises (near monopolies in some cases), the rapid underlying increase in domestic consumption in China and the simultaneous shift of business into these new online operations in recent years.

Toby Hudson, Fund Manager, Asia ex Japan Equities said:

“'The world’s most valuable resource is no longer oil, but data' , said the Economist earlier this year. Alibaba no longer describes itself as an e-commerce company but as a data business. "Rapid improvements in smartphones, processing power, Artificial Intelligence, cloud computing and other areas of technology are transforming the amounts and types of data that can be collected, stored and analysed within the economy today. "We see this already in the cleverly-targeted adverts that interrupt our social media timelines or the prompts for purchases that are spookily accurate within e-commerce sites – but we are only really scratching the surface today. "Going forward, the companies that can capture and best analyse this explosion in data traffic will be best placed to exploit the new business opportunities.

"In China the dominant ‘platform’ companies like Tencent, with over 900 million users on its social media platform, and Alibaba, with 500 million-plus users across its various applications, are effectively the ‘gate-keepers’ for much of this data gathering. "They are best placed to know more about us as consumers than anyone else in the modern economy. "Today these companies make money primarily from e-commerce and advertising (Alibaba), or gaming (Tencent), but as tastes and businesses evolve so will their revenue models. "The real value of the companies is in their ubiquitous eco-systems that can dominate our attention online and capture this flow of data."

Eyes on the prize

The huge scale of China’s online economy speaks for itself. For example, online retail sales on Singles Day (11 November) in China dwarfs the takings of Cyber Monday in the US. The former, run by e-commerce giant Alibaba on a number of its platforms, raked in US$ 17.8 billion of sales in only 24 hours, versus Cyber Monday’s US$ 3.5 billion in revenue. A vast range of everyday tasks in China are now carried out, and increasingly paid for, online. Total mobile payments from third-party providers (with Tencent’s Tenpay and Alibaba’s Alipay the dominant players) in China last year totaled an estimated US$ 5.5 trillion – over 50 times the equivalent value in the US1.

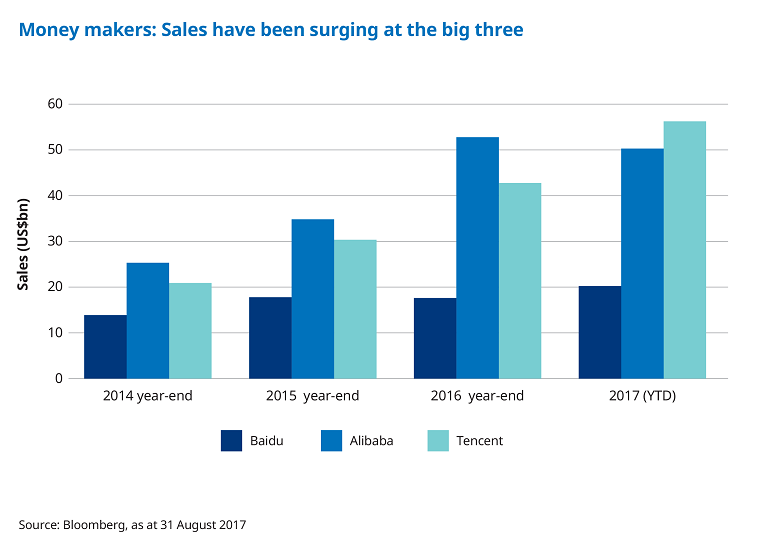

From ordering a latte at Starbucks to requesting a ride with Didi Chuxing, the online economy in everyday life is ubiquitous in China. It’s no wonder that revenue at the giants has been increasing at such an impressive rate (see below).

China’s annual consumption is expected to grow from US$4.4 trillion in 2016 to US$9.7 trillion by 20302. What is interesting to note is this growth is no longer primarily driven by the wealthier Tier 1 and Tier 23 cities, but rather the smaller Tier 3 and Tier 4 cities – which will account for two-thirds of the increase in spending over this period.

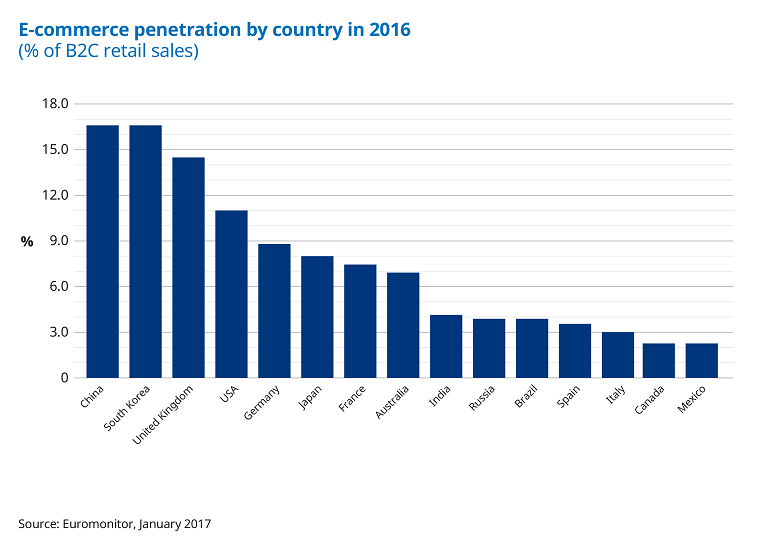

E-commerce penetration in China is already among the highest in the world (see below) and reached nearly 17% of all business-to-consumer (B2C) retail sales in the country last year.

Big spenders

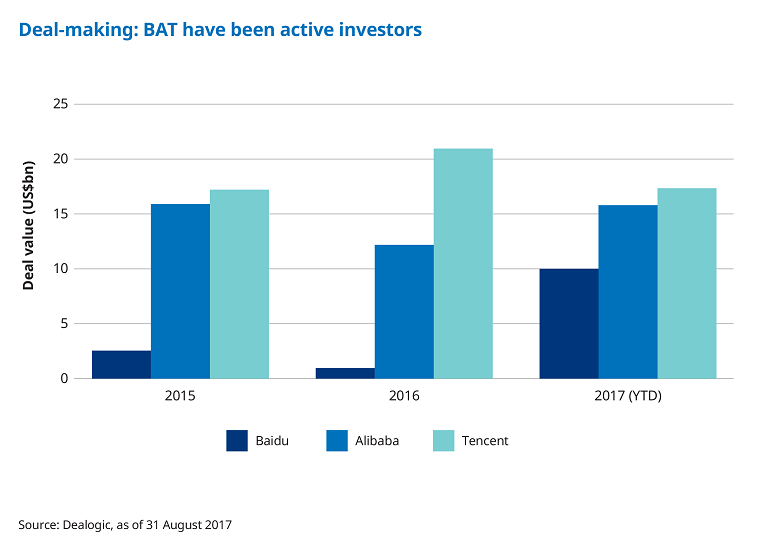

Alibaba (in e-commerce) and Tencent (in gaming primarily) have also made significant investments overseas to broaden their reach. The two companies have huge cash reserves on their balance sheets, allowing them to acquire or take strategic stakes in emerging businesses in other geographies.

One new battleground is Southeast Asia, where the opportunities of the online economy in countries such as Singapore and Indonesia are spurring a flurry of deals, most notably Alibaba’s acquisition of leading e-commerce platform Lazada. This potentially opens a whole new leg of growth for the Chinese companies as the internet, payments and logistics infrastructure catches up in other emerging economies – allowing e-commerce penetration to rise more rapidly.

Diesen Beitrag teilen: