Morgan Stanley IM: Where Did Volatility Go?

May proved to be a relatively quiet month, despite some large data surprises. U.S. employment and inflation data both surprised: employment to the downside (by a very wide margin) and inflation on the upside (the biggest surprise in several decades).

25.06.2021 | 10:20 Uhr

Here you can find the complete article.

As these two variables remain front and center for the Fed, investors are obviously interested in them. Unfortunately, the data is so confusing, distorted by re-openings, supply side constraints, both on the labor and raw material front, and varying vaccination rates, it is difficult to extract a signal or message from them. So, all in all, the market was not irrational to shrug them off and continue with the same constructive narrative as earlier this year: strong growth; moving to herd immunity; overheating goods (and housing) market; rapid growth in nominal incomes; commitments in most major countries to keep both fiscal and monetary policy easy. But volatility will not remain suppressed forever! Eventually data will become cleaner and point to either faster than expected growth and inflation or the opposite.

It is not surprising, then, that most developed market bond yields were slightly lower to unchanged in the month. Interestingly, despite strong real economic data (except for the U.S. jobs report) and higher than expected inflation, real yields fell again. A notable exception to this story were interest rates in New Zealand, which rose sharply following comments at the Reserve Bank of New Zealand’s (RBNZ) May meeting around tightening monetary policy. The Fed maintained its view that elevated inflation prints are transitory, and will revert back to “normal” levels over time. The Bank of England (BoE) kept interest rates steady and slowed the pace of asset purchases. The ECB delivered a dovish tone, signaling there would be no major change to policy at the June meeting. However, the situation in emerging markets is vastly different. By and large emerging markets (EM) central banks are becoming more hawkish, either raising rates or adjusting forward guidance tighter. Turkey, Brazil, Russia raised rates. Hungary, Czech and Poland are slowly moving in that direction.

Credit market volatility also remained well contained, with U.S. credit slightly outperforming Euro. Again, nothing happened in May to shake the market out of its view that credit remains attractive despite demanding valuations (at least by historical standards). Compression in spreads between higher and lower quality issuers continues, but it is getting late in the game. It will be increasingly difficult for lower quality securities to significantly outperform higher quality ones. It also must be mentioned that index composition does change over time, in some cases quite substantially. The Bloomberg Barclays U.S. Corporate High Yield Index is at its highest credit quality in over a decade as the BB bucket has grown substantially due to downgrades while a number of CCC-rated companies have defaulted and left the index (particularly on the energy front). On the other hand, investment grades (IG), represented by the Bloomberg Barclays U.S Corporate Index, has the lowest average credit quality in over a decade as more companies were downgraded to BBB by design or by accident (e.g., the pandemic wreaking havoc with companies’ balance sheets). This makes current HY valuations less high than they appear but IG worse compared to historical levels.

The bottom line is that an investment strategy focused on a continuation of low nominal (and in particular real) yields, strong growth (in output and incomes), rising vaccination rates, and stable policy remains intact. While it is difficult to believe that global developed market yields will not go higher, today is not the day for it to happen. Both credit spreads and government yields look like they are settling into a summer range awaiting clarity on the data and policy front. In the interim, full steam ahead with a focus on credit sensitive assets (relative to risk free ones), in terms of corporate credit, selective emerging markets and securitized credit. Oh, and by the way, higher inflation, and easy Fed is not -- in our opinion -- a recipe for dollar strength.

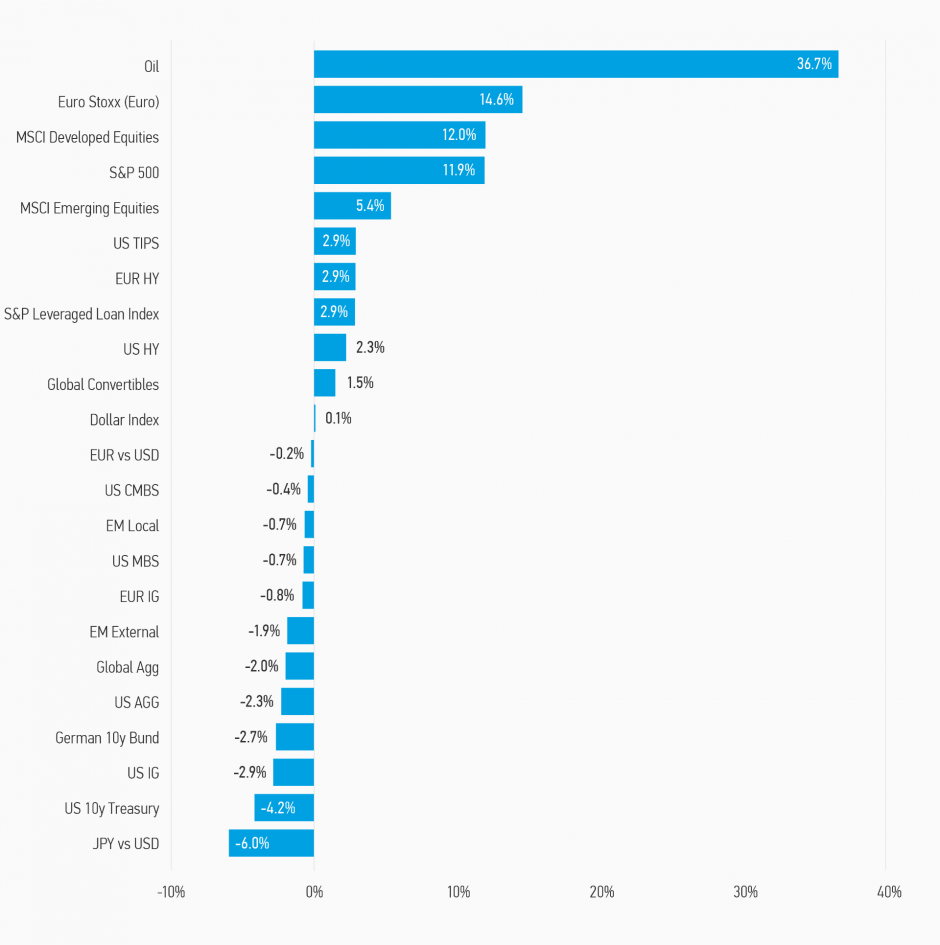

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of May 31, 2021. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

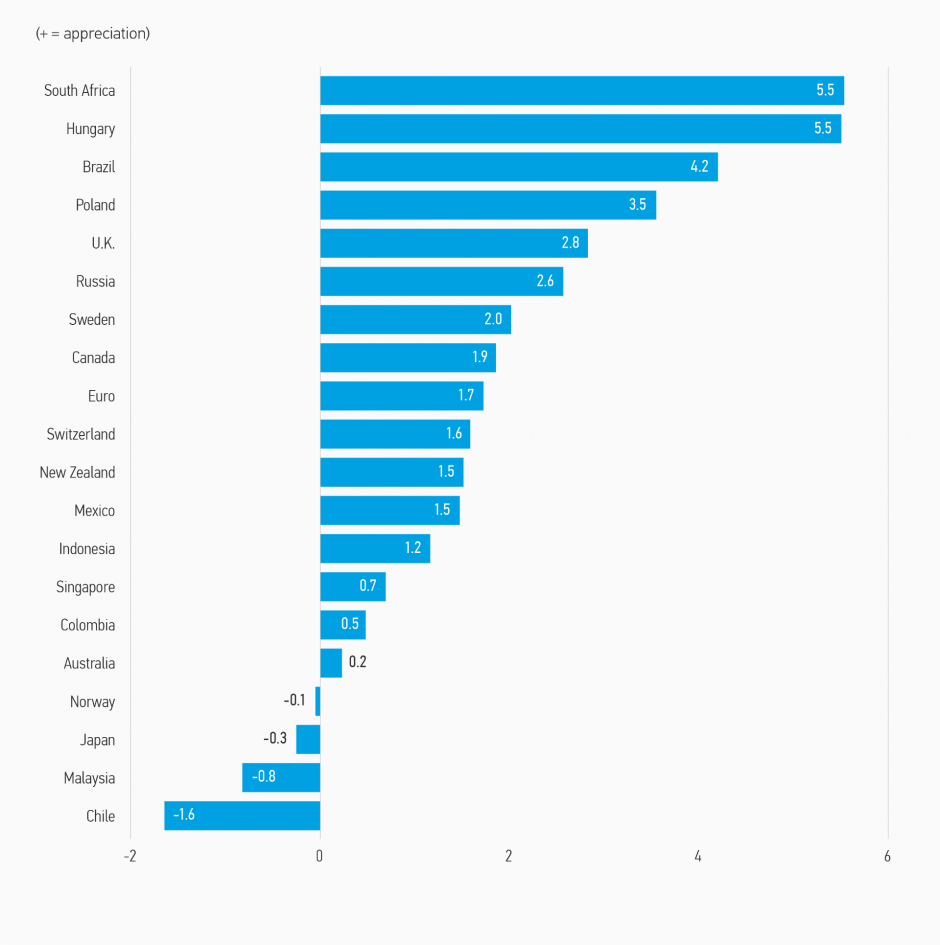

Display 2: Currency Monthly Changes Versus U.S. Dollar

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of May 31, 2021.

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of May 31, 2021.

Fixed Income Outlook

Sometimes it is difficult to not sound like a broken record and this time is one of them. Not much changed in May with regard to understanding the medium term investment outlook and thus little reason to adjust investment strategy. The future looks as clear as can be with regards to growth - likely to be strong - and very murky when it comes to inflation - it’s going up, but for how long and by how much? There was no change in views from policymakers about current stances of policy, but data is sufficiently robust in the U.S. that discussions of tapering are sure to start this summer, but that could be July, August or September. It is still all very data dependent and subject to qualitative interpretation. For example, is 500k job gains on average over the first half of the year good enough to count as a “string” per Chairman Powell’s dictum? Or does he have another number in mind? I guess we will know when we know! What that means is that the data is likely to have to be overwhelmingly favorable for the Fed (and ECB, BoJ, BoE, etc.) to take the risk of tightening, or just running a less accommodative, but still accommodative, policy.

The performance of government bonds is understandable from one perspective but not from another. On the one hand, data is sufficiently murky with regard to “true” medium term strength of the economy (something one needs to know to value longer term yields) so that it is dangerous to be very confident that current strength will continue long enough to break the back of secular stagnation and get forward U.S. yields over 2.5%. On the other hand, real yields are negative all along the yield curve. This does not look right from a medium term perspective, especially with growth dynamics worldwide looking so good, not just for this year but for the next few years. While we are inflation optimists (inflation will not run away to higher levels), inflation is likely to be higher for the next few years than it was in the 2018/2019 period. This should push nominal yields higher. The Fed will (we hope) be able to push the real Fed funds rate at least back to zero, at some point. The same type of analysis holds for most DM economies. But, given Fed’s FAIT (flexible average inflation target) strategy, policy rate normalization should take a few years. This means that it will be difficult for the U.S. Treasury 10-year yield to surpass 2%. As we’ve seen in recent months, the 1.75% barrier has held. So, the bottom line is that we should be cautious on interest rate risk, but, unless valuations get very rich again, do not get too bearish.

Inflation remains high on investors watch list. And rightfully so. Unfortunately, there is so much volatility in economies that it is difficult to sort signal from noise. For example, a U.S. nonfarm payroll employment report which varied from 300k to 1 million would not look surprising. The various forces at work in the labor market are sometimes working at cross purposes, e.g., extended/high unemployment benefits could keep workers sidelined even as labour demand rebounds as the economy re-opens. Encouraging people to return to work, wage data has been very strong and we do know that rising wages is a necessary condition for higher inflation to take hold. This is worrisome. But we are likely to have to wait until September/October when excess benefits roll off, children go back to school, and vaccination rates are even higher to know if labor supply will fully re-engage. In addition, product and commodity prices have rocketed higher due to supply bottlenecks. On the other hand, service sector inflation remains subdued as social distancing measures remain in place and the output gap is thought to be large. There is also the statistical issue of how to correctly calculate inflation for sectors where normal services have been severely constrained and consumption patterns have shifted (but possibly only temporarily). An opening up of the economy, and a surge in pent-up demand, could lead to a surge in prices, but it is uncertain how sustained such an increase will be. We are expecting the current inflation spike to be temporary but, as always, things need to be monitored. Policymakers are likely to act as if it is temporary and not troubling for at least the next few months. That said, several central banks in some smaller developed countries (Canada, New Zealand, Czech) have hinted they will be reigning in accommodation in the next year, sooner than expected, and some BoE MPC members have suggested rate hikes could be warranted in the UK next year. Several emerging market central banks have already begun to tighten, being more concerned than DM central banks typically are about higher inflation weakening their currencies. The good news is that tightening of policy is already discounted in most of these countries’ yield curves. But, easing has globally ended. The end game is upon us but it is likely to be a very, very long game.

Cyclical assets should remain well supported in this environment: low real yields, FAIT, vaccination roll outs still ongoing, and strong nominal income growth. Despite their having demanding valuations, maintaining a below average credit quality portfolio still looks correct. Emerging markets should also begin to catch up to developed economies in the second half of the year and their strong May performance should carry on. However, the spread or return compression between higher and lower rated high yield bonds looks nearly complete. Down in quality moves into CCC rated bonds, for example, are likely to lead to much smaller capital gains opportunities going forward. That said, the economic environment is so good, defaults should fall over the next 12 months (indeed, it looks like we are likely to be in a credit upgrade cycle), so remaining overweight lower quality bonds still makes sense to capture the additional yield. Significant risk taking should be confined to idiosyncratic opportunities where risk premiums are elevated (there are still some of those!) The danger, of course, being that this usually only occurs when something goes wrong and risks have risen. Good research; bottom-up analysis remains key. The very varied performance amongst emerging market countries attests to that.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

In May, most developed market bond yields were slightly lower to unchanged, as incoming economic data continued to be strong and inflation concerns remained topical. A notable exception were interest rates in New Zealand, as rates rose sharply following comments at the RBNZ’s May meeting around tightening interest rate policy. The Fed maintained its view that elevated inflation prints are transitory and will revert back to “normal” levels over time. The Bank of England (BoE) kept interest rates steady but slowed the pace of asset purchases and some MPC members suggested rate hikes are possible in 2022. The ECB delivered a dovish tone, signaling there would be no major change to policy at the June meeting.

Outlook

Recent data and information flow continue to imply 2021 economic growth will be very strong. Falling infection rates, vaccine rollouts, strong efficacy results, massive U.S. fiscal stimulus, high savings rates, economic re-openings and dovish central banks are buttressing a very positive outlook for economies. With the $1.9 trillion support/stimulus package being implemented, U.S. fiscal policy is on a trajectory to significantly improve 2021/2022 growth globally, not just in the U.S.

While we do not expect a dramatic sell-off in government bond markets, we think the risk is skewed to yields rising, as valuations are still rich relative to history and there is potential for additional term premia to be priced across the yield curve. The current surge in inflation is expected to be transitory but there is a risk it becomes more persistent due to higher wages and inflation expectations. The fact that real yields remain close to all-time lows suggests financial conditions remain very accommodative.

Emerging Market (EM) Rate/FX

Monthly Review

EM debt returns were positive in May, across the board, i.e., in both local and hard currency bonds. From a sector perspective, companies in the Infrastructure, Oil & Gas, Industrials, Pulp & Paper led the market, while those in the Financial, Utilities, TMT, and Transport sectors underperformed.

Outlook

We remain constructive on EM Fixed Income assets on the back of continued stability in UST yields, a steady movement towards reopening in developed markets, and a pickup in vaccination rates in several EM economies. However, setbacks in the fight against COVID could render several EM economies vulnerable to new virus strains, weighing on growth and already fragile fiscal accounts. More generally, a delayed transition to fiscal consolidation may prompt the market to demand higher risk premiums in EM fixed income. Domestic political risks, such as upcoming elections in several Latin American economies, could also negatively impact asset prices.

Credit

Monthly Review

Credit spreads over the month were a touch wider in Euro IG and tighter in U.S. IG. Credit markets benefitted from slightly higher equities and lower volatility in the month. The main support in the market was continued central bank messaging that it was too early to consider reducing the policy report, despite inflation data coming in above expectations. Commodity prices also continued to rally with oil leading as demand expectations rose.

Market Outlook

We see credit being supported by expectations of an economic rebound in 2021 as well as continued positive support from monetary and fiscal policy as rates stay accommodative and QE strong. We expect continued strength with a potential price overshoot in the first half of the year, with a correction in the second half as M&A increases, questions are asked over the level of QE in 2022, and as fear of missing out buying activity turns to fear of owning valuations that look historically expensive.

Securitized Products

Monthly Review

May was a very quiet month in terms of both market activity and market volatility. Interest rates remained range-bound despite volatile economic data. Agency MBS spreads drifted slightly wider as whispers of potential tapering of the Federal Reserve’s (Fed) MBS purchases became more frequent. U.S. Non-agency residential mortgage-backed securities (RMBS), Commercial mortgage-backed securities (CMBS), and U.S. asset-backed securities (ABS) spreads were essentially unchanged in May.

Outlook

We continue to have a positive outlook on residential and consumer credit sectors and a more cautious view on CMBS. We believe agency MBS now looks expensive on a historical level basis and a risk-adjusted basis. U.S. non-agency RMBS still offer reasonably attractive relative value. U.S. ABS continues to have mixed outlook, with traditional consumer ABS (credit cards and auto loans) looking relatively expensive while the more COVID challenged ABS sectors continue to offer much greater recovery potential. CMBS valuations remain very idiosyncratic, with some attractive value opportunities and some potential credit problems as well. Hotels and shopping centers have been severely impacted by the pandemic, and remain vulnerable to high levels of defaults.

RISK CONSIDERATIONS

Diversification neither assures a profit nor guarantees against loss in a declining market.

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, and correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: