BNP Paribas AM: Structural reflections on the mid-year market outlook

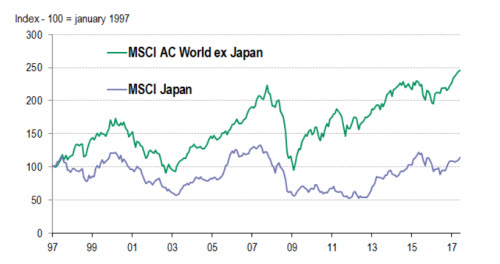

There are many reasons for the disappointing performance of Japan’s equity markets over the last 20 years, and of its fixed-income markets too. The spur for the initial poor performance was not the market bubble itself, but the delayed reaction to it.

25.07.2017 | 11:39 Uhr

Lessons to be learnt from the performance of Japan’s financial markets

Exhibit 1: Performance of Japanese equities relative to global equity peers, since 1997

Source: Bloomberg, BNP Paribas Asset Management, as of 06/07/2017

The Bank of Japan did not react aggressively enough to the crash and the country’s banks took years before they finally wrote down the value of the bad loans on their books. This slow and inadequate policy response has since been exacerbated by the demographic drag from a shrinking and ageing population.

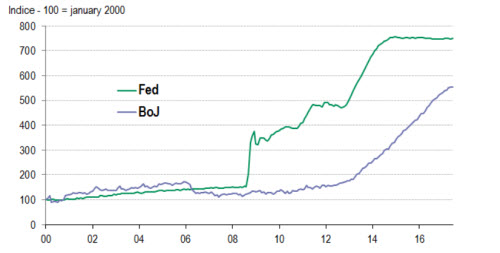

The Federal Reserve learned from Japan’s errors and responded much more quickly to the 2007-08 Global Financial Crisis, with the ECB following rather later but still in a reasonably timely fashion. American commercial banks wrote off their loans early in the crisis and soon returned to providing credit to the economy. Europe was again tardy (and in Italy’s case it still hasn’t adequately dealt with its problems), but still the system is today well capitalised.

Exhibit 2: Total assets held by the Federal Reserve and the Bank of Japan

Source: Bloomberg, BNP Paribas Asset Management, as of 06/07/2017

Both the US and Europe face similar demographic challenges but not to the same degree as Japan. The US in particular has traditionally been more open to immigration to boost its population and is far less densely populated than Europe, so it has a greater capacity to absorb new workers. The US economy is also more flexible than Japan’s and hence is likely to be better able to adapt to the changing economic landscape.

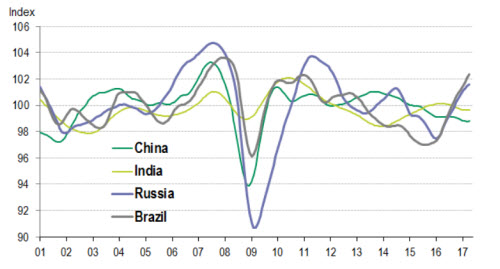

A good run by emerging market assets – but is it a temporary recovery or a secular change?The fundamental arguments in favour of emerging markets, namely, growing populations, rising middle classes, the potential for productivity gains, etc., are as valid today as they were 40 years ago. The outlook is in fact rather brighter today as emerging market economies are generally more stable politically and economically. To illustrate this, consider that the US dollar has appreciated by over 50% since 2011 with little sign of an emerging market debt crisis. Central banks have built up currency reserves and most emerging market currencies now float against the dollar.

Exhibit 3: OECD Leading indicators for selected emerging markets

Source: Datastream, BNP Paribas Asset Management, as of 06/07/2017

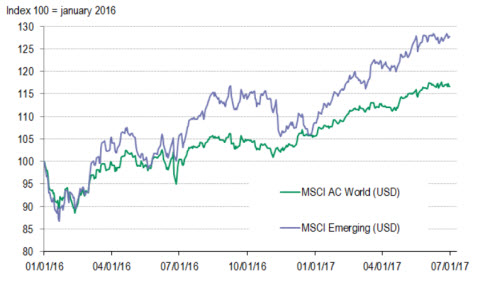

The returns for emerging market equities, however, were worse than those for developed market equities for an extended period following the Global Financial Crisis. They underperformed by 66% from 2010 to 2015 and have only recovered 7% of the underperformance since. Emerging market debt has done much better. The JP Morgan EMBI Global Diversified index has markedly outperformed the Bloomberg Barclays Global Aggregate index since October 2008 (12% annualised gains vs. 4%).

Exhibit 4: Relative performance of equities in developed and emerging markets since 01/01/16 (through 30/06/2017)

Source: Bloomberg, BNP Paribas Asset Management, as of 06/07/2017

The recent positive returns for equities are really just a return to form following the dramatic disruption from the GFC. In our view, the outlook remains good and, despite the recovery so far, both valuations and margins for emerging equity markets are still lower than they are for developed markets, meaning there is greater scope for price appreciation. Emerging market debt, on the other hand, may struggle to maintain the pace of gains in 2016. Spreads now are narrow and the Fed is still likely to hike rates two times this year, but over the longer term, the extra yield on emerging market debt should compensate for the risk.

Diesen Beitrag teilen: