NN IP: Beneath the surface

Beneath the surface we notice a return of the reflation trade. Financials and cyclical sectors outperform the bond proxies and the value style outperforms growth. Behavioural dynamics, however, still signal caution and hold us back from a more aggressive risk-on stance.

28.09.2017 | 15:06 Uhr

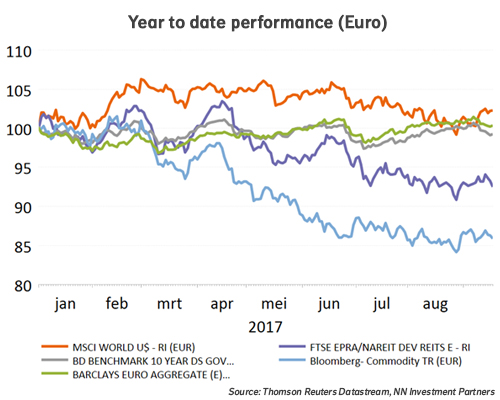

Helped by weakness in the euro following the German election outcome and the unchanged game plan of the Fed, equities and real estate both turned in a decent performance. Bond yields were slightly lower and spreads widened, especially in emerging market debt. The relative weakness in emerging market assets (both equities and fixed income) can be attributed to weakness in Chinese data coupled with the impact of the Fed meeting and a continuation of the war of words between the US and North Korea. We do however think this is only temporary.

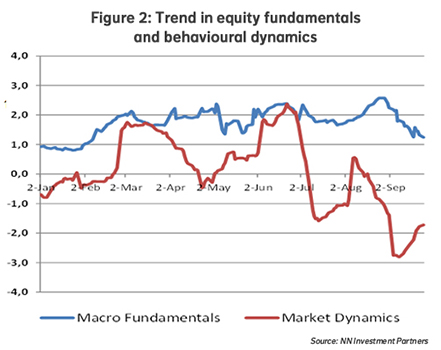

Our scorecard provides a mixed picture when we compare the fundamental drivers with the more behavioural dynamics. The former are clearly supportive as illustrated by the strength in macroeconomic data, earnings growth expectations and attractive risk premiums. The behavioural side, where we measure investor sentiment and look at price momentum and investment flows signals caution. We illustrate this for equities in Figure 2.

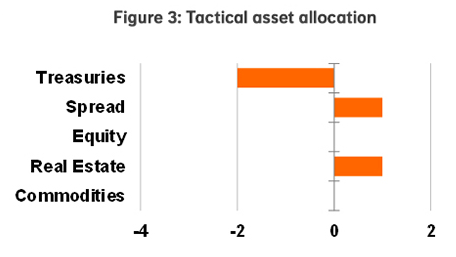

We made no changes in our allocation this week. We have a medium underweight in Bunds and hold on to our small overweights in real estate and spread products.

Of course, below the surface we notice a return of the reflation trade. Financials and cyclical sectors outperform the bond proxies. Value outperforms growth and small caps do better than large caps.

Diesen Beitrag teilen: