Janus Henderson Investors: Global business investment cycle moving into H1 low

The forecast here – before the coronavirus shock – that the global economy would remain weak in H1 2020 rested partly on a judgement that the business investment cycle had yet to reach bottom. Recent news is consistent with this judgement.

20.02.2020 | 07:48 Uhr

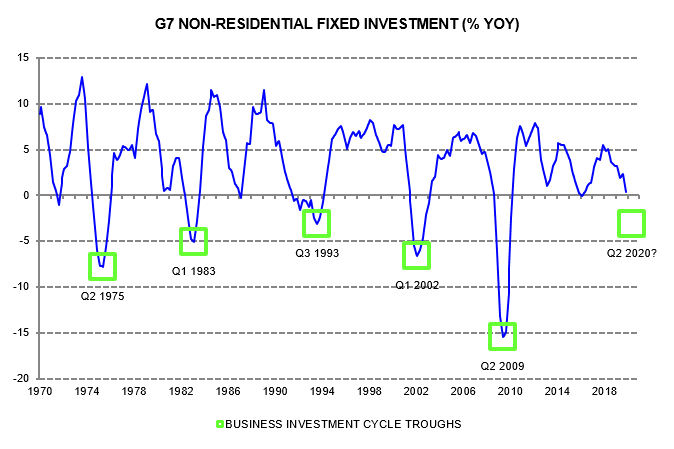

The business investment or Juglar cycle (after nineteenth century French economist Clément Juglar) ranges between 7 and 11 years. Cycle lengths are measured between troughs. Lows are marked by a year-on-year contraction in investment. The last G7 trough occurred in Q2 2009 and ended a short cycle (7.25 years) – see first chart. This suggested that the current cycle would be of above-average length – the 11 year maximum would imply a trough in Q2 2020.

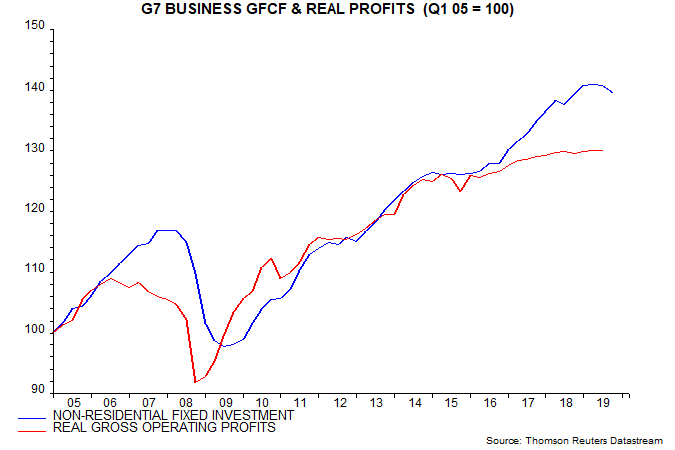

Previous posts noted that G7 business investment had slowed but was still rising year-on-year as of Q3 2019. Growth since 2016 had opened up a large gap with stagnant real gross operating profits – second chart. This suggested that investment would weaken into H1 2020 – contrary to a consensus expectation that the US / China trade “truce” would trigger a rebound.

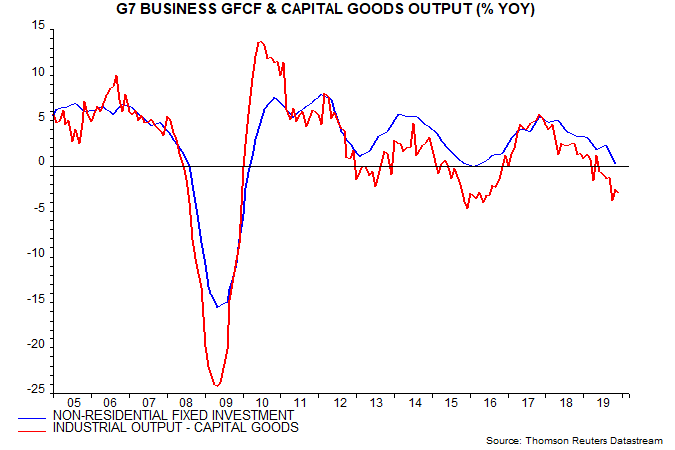

The G7 year-on-year investment change is estimated to have fallen to around zero in Q4 2019, with weakness confirmed by declining industrial output of capital goods – third chart.

The year-on-year investment change also reached zero in Q1 2016, with capital goods output falling. The possibility that the business investment cycle had reached a trough was considered here but rejected because 1) the year-on-year change had not turned negative, 2) the implied cycle length of 6.75 years was outside the 7 to 11 year range and 3) weakness was energy-focused, following the 2014-15 oil price collapse, rather than general.

The year-on-year investment change was expected to turn negative in H1 2020 even before the coronavirus shock, partly reflecting an unfavourable base effect – investment rose by 1.1% between Q4 2018 and Q2 2019. The shock will magnify the fall and may push back the trough to Q2 2020.

What reasons are there to expect business investment to recover in H2 2020, apart from the time limit on weakness implied by the 11 year maximum cycle length? The fall in long-term interest rates since late 2018 is stimulating housing activity and should start to support business investment – which usually responds with a longer lag – later in 2020. Business real narrow money trends, meanwhile, anticipate turning points in the investment cycle and recovered in the US, Japan and Euroland during 2019.

Jetzt weiterlesen

Dieser Inhalt ist für professionelle Anleger bestimmt. Mit Klick auf "Weiter" bestätigen Sie, dass Sie ein professioneller Anleger sind und stimmen unserer Datenschutzerklärung zu.

Weiter

Diesen Beitrag teilen: