DeGroof Petercam: Asset Allocation Flash

Despite the flow of negative news about protectionism and crises in emerging economies, global growth is holding up well in Q3. Moreover, the labour market has continued to strengthen, particularly in the US, making two more rate hikes this year increasingly likely.

03.10.2018 | 16:27 Uhr

Global manufacturing growth and world trade have slowed, but this remains largely offset by strong services growth so far. That said, after the strong synchronised upturn in 2017, the pace of global economic activity is likely to slow down further.

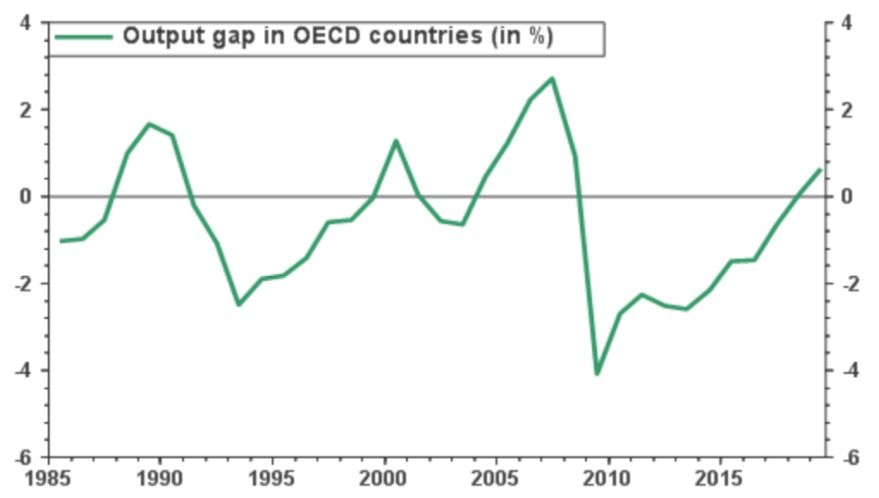

The weakness of the manufacturing sector is consistent with evidence that global trade has slowed. What’s more, expectations for global trade point to a further deceleration in the months to come. Rising protectionism remains a key risk for the world economy. While current tariffs remain modest, the risk for subsequent tit-for-tat increases is high. Besides, the negative output gaps witnessed over the past decade have closed in most parts of the world so that momentum for catch-up growth is fading. The prospect of tighter monetary conditions, a gradually diminishing effect of US fiscal stimulus measures, capping commodity prices, a more difficult international trade environment and less Chinese capital investment signal a growth slowdown in the quarters ahead. The only thing missing is a significant and broad-based pick-up in inflation. So far, firming economic activity has only modestly translated into rising wage and inflation readings.

Headline inflation has been creeping higher but this is mainly the result of the year-on-year evolution in energy prices. Core inflation, meanwhile, remains quite modest. There has been a lot of talk about the death of the Phillips curve but it might be premature to confirm that message. Survey measures of hiring difficulties indicate that labour markets have continued to tighten. All in all, inflationary pressures are slowly but gradually building.

At the same time, other factors including globalization, technological change and digitization, the ageing of the population, insufficient labour union power, lower anchored inflation expectations and sluggish productivity growth suggest that inflation is unlikely to break out any time soon. Indeed, in recent years wage growth has become less sensitive to changes in labour market conditions.

The sharp rise in both the ISM manufacturing and non- manufacturing surveys in August suggests that economic growth remains robust in the third quarter. The PMIs on the other hand have been more downbeat. The United States are currently seeing the second-longest economic expansion in history with second quarter growth coming in at over 4% annualized. It is difficult to see how this pace of expansion can be sustained for much longer.

President Trump’s tax reforms are boosting economic growth in the short term but will primarily result in deteriorating public finances (towards a deficit of around 4 to 5% of GDP) and growing inequality over time. Moreover, further monetary tightening in the US will eventually bite into economic activity. Meanwhile, the yield curve continues its flattening trend. This is something to monitor closely as it tends to go hand in hand with slower economic growth further down the road. That said, recession odds are still low for now. Consumer confidence is still strong on the back of fairly strong labour market and housing market activity, and the outlook for investment has been improving since late 2016. Inflation is rearing its head again, albeit still modestly, as the labour market is nearing full employment.

During its latest meeting the FOMC left the funds rate unchanged. But the strong momentum in the economy means that more tightening of monetary policy is in the cards. As things currently stand it can be expected that the Fed is looking to hike rates again later this month and, if no negative economic surprises emerge, another rate hike is expected in December. Of course, in case significant volatility in financial markets resurfaces, it may convince the Fed to be more cautious. Further significant flattening of the yield curve over the coming months could well prompt the Fed to pause its monetary tightening efforts at some point in 2019 when the pace of economic growth is likely to slow down. The economic impact from tariffs on Chinese imports remains small so far for now but a global trade war and equity slump would be costly.

Diesen Beitrag teilen: