Degroof Petercam: Wachstum, Inflation, Geldpolitik - die Themen 2016

Sind Prognosen für die Kapitalmärkte von Bedeutung? Angesichts von Notenbanken manipulierter Märkte wird dieses schon schwierige Unterfangen noch komplexer. Dennoch ein kurzer Beitrag über die wichtigsten Themen in 2016.

10.12.2015 | 11:27 Uhr

Heading into 2016

The end of 2015 is approaching. This is the time many observers make predictions for next year. As the Danish philosopher Bohr put it: “prediction is very difficult, especially about the future”. Or using the words of the American economist Solomon: “the only function of economic forecasting is to make astrology look respectable”. In a nutshell, heading into 2016, we think the global economy continues its subdued recovery alongside very loose monetary policy conditions. As always, several important risks remain.

Economic activity

Global growth is not falling from a cliff as many observers feared towards the end of last summer. We believe the global recovery will not end abruptly and instead continue moderately against the background of loose monetary and budgetary policy and also lower energy prices. China’s economy is showing early signs of improvement following earlier stimulus measures. Moreover, leading indicators show that economic activity in most parts of the developed world remains resilient. At the same time, however, all this is still far from spectacular. Global growth is likely to remain fairly subdued. We expect the divergence between decent performing DM and struggling EM to persist next year although the latter group is likely to feel ground beneath its feet again.

Monetary policy

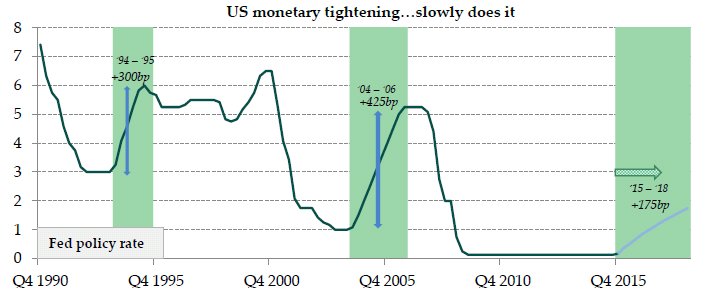

The strong USD, China’s rebalancing and overcapacity will keep downward pressure on global commodity prices. Importantly, however, the earlier drop in energy and industrial metal prices disappears from the year on year price comparison so that these base effects will send headline inflation higher. Underlying pressures of inflation on the other hand are likely to remain modest at best. Despite the looming policy rate hike in the US, the first since 2006, global monetary conditions look set to remain very loose. Whereas the Fed and the Bank of England will start to tighten policy, the ECB, the Bank of Japan and the People’s Bank of China are adding monetary stimulus. Moreover, central bankers in the US and Britain are likely to adopt a very cautious stance.

Balance of risks

Although concerns over both eased in recent months, in line with our scenario, the two most important risks arguably remain faster than expected monetary policy tightening in the US and a hard landing in China. A ‘perfect storm’ in this respect would further expose EM balance sheet fragilities. In this respect, commodity exporters like Colombia, Russia, Chile or Malaysia and countries running large current account deficits such as Turkey and S. Africa remain vulnerable. Closer to home, the Greek situation remains worrying. Although funding is secured following the agreement reached in July, further imposed budgetary tightening will keep Greece stuck in recession with unemployment and public debt at unsustainably high levels. In this context, political risks are likely to remain high.

Der komplette Marktausblick als PDF-Dokument.

Diesen Beitrag teilen: