Morgan Stanley IM: ESG and the Sustainability of Competitive Advantage

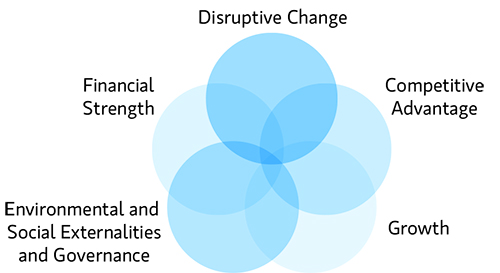

A holistic approach to sustainability — with respect to disruptive change, financial strength, environmental and social externalities and governance (also referred to as ESG) — helps us identify investment opportunities.

10.03.2018 | 11:03 Uhr

The Global Opportunity Team has been investing since 2006 with continual evolution and innovation. Our focus on sustainable competitive advantages and the impact of disruptive change has always incorporated governance. (Display 1) Reflecting rising client interest, we recently formalized the explicit integration of ESG considerations into our investment process for our suite of Opportunity products.

DISPLAY 1: Our Quality Assessment of Companies Has AlwaysIncorporated Governance

ESG Is a Component of Quality

Our investment philosophy is simple: Warren Buffett investment principles applied to growing companies.[1]

We believe that by applying a price discipline to investments in high-quality companies, strictly defined as those we believe have competitive advantages and long-term growth that creates value, we can best capture opportunity and manage risk for clients.

We believe that ESG factors are integral to assessing the quality of a company and thus are a vital part of our investment process. As long-term investors, we aim to thoroughly understand the companies in which we invest. Our bottom-up investment process requires months of rigorous due diligence on companies. We meet with company management, competitors and suppliers while conducting a deep dive into the underlying business fundamentals. When we formulate our investment thesis on the quality of a company, we ask three key questions[2] to determine the sustainability of competitive advantage and how it can be monetized through growth:

Is the company a disruptor or is it insulated from disruptive change?

Does the company demonstrate financial strength with high returns on invested capital, high margins, strong cash conversion, low capital intensity and low leverage?

Are there environmental or social externalities not borne by the company, or governance and accounting risks that may alter the investment thesis?

ESG factors may materially impact investment risk and reward.

Businesses do not operate in a vacuum. In a global economy dependent on cross-border trade, complex supply chains and diverse workforces spanning the globe, companies are increasingly confronted with environmental issues, such as climate change, water scarcity and pollution, as well as social factors including product safety and relationships with regulators and the communities in which they operate. In this context, ESG can directly impact a company’s competitive positioning. Therefore, managing environmental and social factors is simply part of sustaining competitive advantage in today’s economy.

ESG externalities may not be not fully priced into the value of companies.

When companies externalize the price of environmental and social issues upon the communities in which they operate, they are by definition over-monetized—earning excess profits because the costs of externalities are not borne by the company. Investors risk paying the price when such excess is corrected and environmental and social costs are internalized to the company’s income statement.

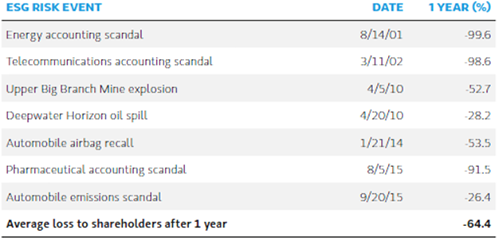

ESG risk events have materially detracted from performance.

In recent years, shareholders have suffered substantial losses following ESG risk events (Display 2). The negative environment and social impacts of oil spills, mining explosions and unsafe products can be fatal, and the cost to shareholders can be severe. In addition, poor governance and accounting controls can undermine the success of even great businesses characterized by sustainable competitive advantages and long-term growth prospects. While there is no silver bullet to avoid such catastrophes, we believe that incorporating ESG analysis can mitigate these risks.

DISPLAY 2: Stock Price Performance One Year Following ESG Risk Event

(Source: Bloomberg. Data as of November 30, 2016. Past performance is no guarantee offuture results.)

ESG Growing in Importance

Our Opportunity Strategies, available on a Global, International and Asia ex Japan basis, are managed by the Global Opportunity Team based in Hong Kong. We are supported by a Corporate Governance Team comprised of professionals responsible for proxy voting, shareholder engagement and environmental, social and governance [3] initiatives across the Morgan Stanley Investment Management (MSIM) community of independent boutiques.

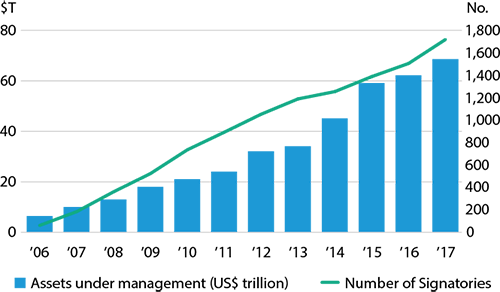

MSIM has been a signatory to the Principles for Responsible Investment (PRI)[4] since October 2013.[5] PRI launched in 2006 after the United Nations (U.N.) convened institutional investors and an expert group from the investment industry and civil society to provide a framework for “the systematic and explicit inclusion of material ESG factors into investment analysis and investment decisions.”[6] Over the past decade, PRI has grown to over 1,700 signatories, representing assets of $68.4 trillion (Display 3).

DISPLAY 3: Growth of Principles for Responsible Investment (PRI)

Investor signatories

(Source: Principles for Responsible Investment (PRI). Data as of April 30, 2017.

Methodology: Total AUM includes reported AUM and AUM of new signatories provided in signupsheet that signed up by end of April of that year. Total AUM for the past three years excludesdouble counting resulting from subsidiaries of PRI signatories also reporting and external assetsmanaged by PRI signatories. AUM for previous years include some element of double counting.)

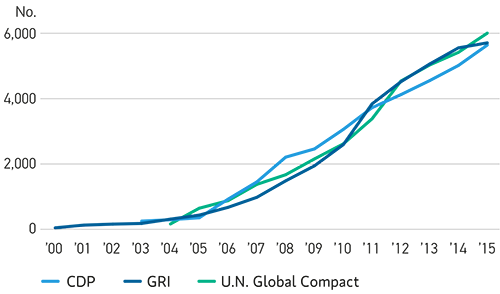

In response to increasing questions regarding how sustainability impacts their business, many companies have implemented sustainability and corporate social responsibility programs, participate in voluntary initiatives and report on ESG standards. For example, in 2000, the U.N. launched the Global Compact to address principles of human rights, labor, environment and anti-corruption. Today, nearly 6,000 companies communicate on progress each year using voluntary reporting frameworks to address the lack of standards in corporate sustainability reporting, including the Carbon Disclosure Project (CDP)[7] and Global Reporting Initiative (GRI)[8] (Display 4). Markets now have vast quantities of ESG data available to incorporate within their broader investment mosaic to help inform investment decision making.

DISPLAY 4: Growth of Corporate Sustainability Reporting

Companies

(Source: Carbon Disclosure Project (CDP), Global Reporting Initiative (GRI), and United NationsGlobal Compact. Data as of November 30, 2016.)

ESG Analysis

Our ESG analysis focuses on a company’s ability to sustain competitive advantage over the long term. In considering candidates for our portfolios, we assess companies’ ESG-oriented strengths and vulnerabilities across several dimensions:

Environment. Environmental management to minimize externalities is crucial to efficient operations. Reducing consumption of energy, water and other resources while reducing emissions, waste and pollution may mitigate costs and improve profitability.

Consumers. Companies can protect their reputation by ensuring product safety, responding to consumer preferences and investing in communities through philanthropic efforts.

Employees. Attracting and retaining talent is crucial, given skilled human capital shortages. Understanding workplace policies with regard to compensation, development, health and safety of employees is important to ensure good relations between companies and their greatest assets.

Suppliers. Continuity of supply chains through effective management of operations and regular supplier audits is increasingly important in an interconnected world.

Regulators. The potential impact of any regulatory and legislative changes that could alter an investment thesis warrants assessment.

Governance. Analysis can focus on management incentives, capital allocation, independent and engaged boards, and transparency of accounting. Within the emerging markets, where rule of law and corporate governance standards can be lower than developed markets, additional due diligence steps are necessary. Risks stemming from corruption, political instability, governance and accounting issues must be thoroughly investigated.

For every emerging market company, we commission a full due diligence report, including a background check on company management, board directors and cross-holdings, court and tax filings, and local language press to assess governance risk.

This is not an exhaustive list, and we are cognizant of the fact that ESG risks from emerging areas such as nanotechnology or genetically modified organisms can be difficult to quantify. Regional differences in legal and regulatory policies and inconsistencies in data are common challenges. Social issues can take on different meanings and context in different parts of the world. We do not claim to have figured out all the answers—we can only state how we incorporate ESG within our investment process.

To be clear, ESG integration should not be confused with socially responsible investing (SRI), which traces its origins to religious organizations investing in a manner consistent with their ethical values.[9] SRI strategies typically practice negative screening to exclude companies involved in “sin” industries such as gaming or tobacco, or complicit in human rights abuses such as slave trade or apartheid. Nor is ESG integration a thematic approach focused on “green investing” in environmental technologies or “impact investing” emphasizing social values such as poverty alleviation.

Incorporating ESG-related potential risks and opportunities within an investment process is about ensuring long-term stewardship of capital.

ESG Factors Influence Investment Decisions

We consider the valuation, sustainability and fundamental risks inherent in every portfolio position. As bottom-up investors, we do not apply top-down ESG positive/negative screens to a benchmark. Nor do we utilize ESG scorecards from third parties which rank companies versus industry peers. In other words, ESG in isolation is not a principal driver of our investment thesis; it is but one component of our quality assessment. Over the years, our research has identified ESG risks that diminished the investment thesis of several companies and resulted in the sale of (or decision not to invest in) a company's securities. For example:

We sold a position in an Asian infrastructure company due to governance concerns and lack of accounting transparency. We noticed an auditor footnote in the annual report that indicated a disagreement with management on revenue recognition of a single related-party transaction. Upon in-depth analysis, we determined that aggressive accounting likely masked a deterioration of the business fundamentals. Subsequently, not a single sell-side analyst highlighted this scenario, indicating lack of proper due diligence and limited concern for governance in this emerging market.

We decided not to invest in an Asian retail company due to governance concerns following our due diligence on company management, board of directors and holdings structure uncovered company purchases of family assets.

We sold a position in a European consumer products company after determining that its competitive advantage was not sustainable as it externalized the healthcare costs of tobacco products and was therefore over-monetized while reliant on pricing growth due to declining unit volumes.

We decided not to invest in a U.S. fossil fuel company due to the increased risk of environmental regulation and potential disruptive change from the declining cost of solar and advances in battery technologies.

Long-Term Ownership Mindset

We seek to own big ideas that win over time. Investing as long-term owners allows us to concentrate capital in our highest-conviction ideas for typical holding periods of three to five years. Over extended time horizons, we believe that ESG risks are more likely to materialize and externalities are more likely to be priced into the value of securities. Therefore, we continue to innovate and evolve our process and believe that integrating ESG within our investment analysis improves the investment risk and reward profile of client portfolios.

The full version of the article can be downloaded here.

1 The team applies what they believe to be investment principles similar to those of Warren Buffett. No representation is being made that the team’sinvestment results will be similar to those produced by investment portfolios managed by Warren Buffett.

2 The information presented represents how the investment team generally applies their investment processes under normal market conditions.

3 Morgan Stanley Investment Management,Our Approach on Environmental, Social, andGovernance Factors (May 2016).

4 Principles for Responsible Investment, The SixPrinciples, available at: https://www.unpri.org/about/the-six-principles: 1. We will incorporateESG issues into investment analysis and decisionmakingprocesses. 2. We will be active owners andincorporate ESG issues into our ownership policiesand practices. 3. We will seek appropriate disclosureon ESG issues by the entities in which we invest. 4.We will promote acceptance and implementation ofthe Principles within the investment industry. 5. Wewill work together to enhance our effectiveness inimplementing the Principles. 6. We will each reporton our activities and progress toward implementingthe Principles.

5 PRI, Reporting Framework (November 2016).Information presented in this report is reporteddirectly by signatories. It has not been audited byPRI. PRI makes no representation or warranties asto its accuracy of any error or omission.

6 PRI, A Practical Guide to ESG Integration for EquityInvesting (September 2016).

7 Carbon Disclosure Project (CDP), Global Climate Change Report (September 2015).8 Global Reporting Initiative (GRI), Sustainable Disclosure Database (2016).9 The Forum for Sustainable and Responsible Investment, SRI Basics.

Jetzt weiterlesen

Dieser Inhalt ist für professionelle Anleger bestimmt. Mit Klick auf "Weiter" bestätigen Sie, dass Sie ein professioneller Anleger sind und stimmen unserer Datenschutzerklärung zu.

Weiter

Diesen Beitrag teilen: