Columbia Treadneedle: No winners in the Thames Water travails

Whatever angle you look at things from the prospects for future investment in the UK water sector don’t look good, for anyone. The travails of Thames Water especially (but other water companies are not exempt) have wrought such damage to the sector’s reputation that water, once a byword for the essence of life, is now more commonly aligned in headlines with words including risk, sewage and pollution.09.08.2024 | 10:44 Uhr

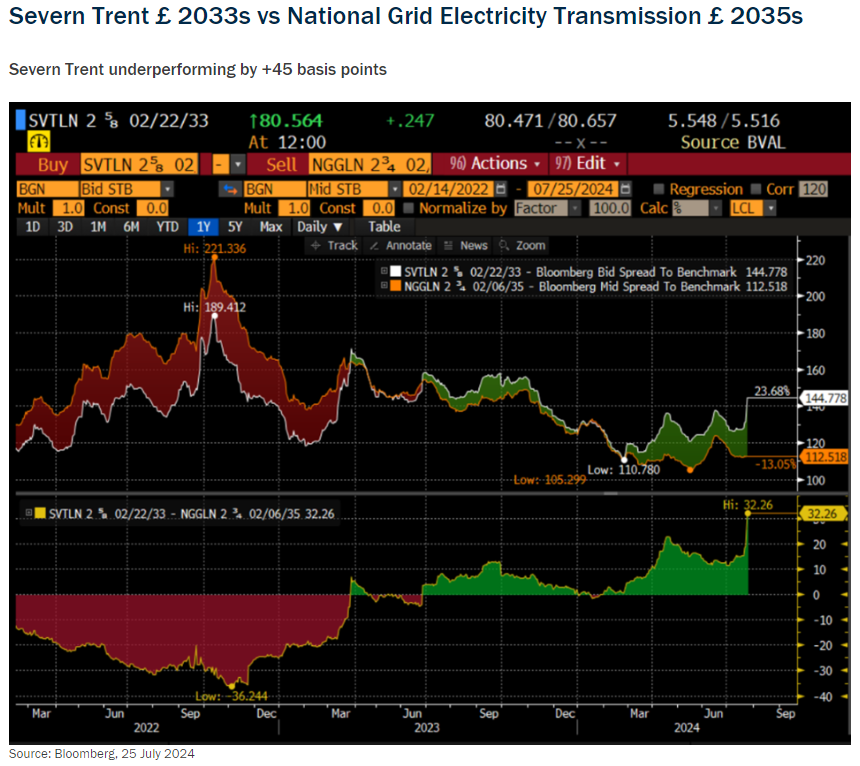

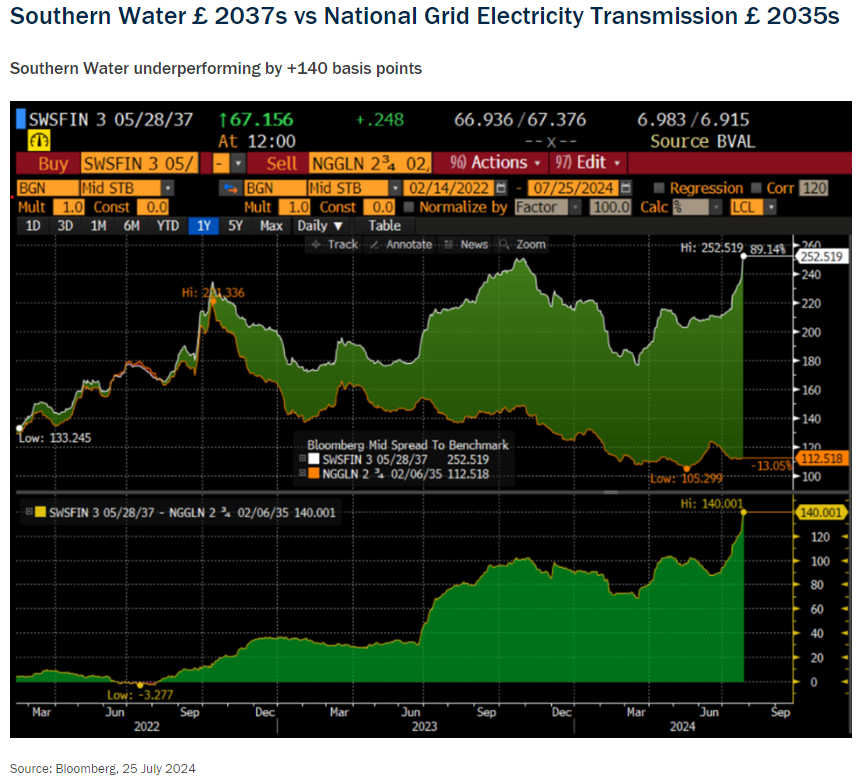

Whether in infrastructure, through the Regulated Asset Base (RAB) compensation model, or the investment markets, attracting further injections of much needed cash are going to be difficult. This is not least because recent events raise the potential for aggressive haircuts to senior Class A debt. The market is already pricing in such an event, despite that debt amounting to less than 80% of the Regulated Asset Base (RAB) of the business. This has caused spreads to widen for all companies operating in the sector. And, on a comparison with other sectors, say UK Electricity or European/US utilities, spreads for bonds in the UK Water sector have widened significantly.