Die besten Emerging Markets Fonds

Welche Märkte stehen nach der US-Wahl bei den großen Investoren hoch im Kurs? Die jüngste Umfrage von der Bank of America (BofA) bringt Licht in das Dunkel. Neben US-Aktien stehen Schwellenländer auf der Kaufliste der internationalen Starfondsmanager.

14.11.2024 | 09:30 Uhr

Schwellenländer profitieren von einzigartigen demografischen Vorteilen. Anders als die entwickelten Märkte, die zunehmend mit einer alternden Bevölkerung konfrontiert sind, haben die Schwellenländer eine überwiegend junge Bevölkerung und eine wachsende Mittelschicht. „So werden beispielsweise bis 2050 fast 28 Prozent der Bevölkerung in den Industrieländern über 65 Jahre alt sein, während es in den Emerging Markets nur 15 Prozent sind. Die junge Bevölkerung, die Verstädterung, die wachsende Mittelschicht und die steigende Erwerbsbeteiligung der Frauen werden allesamt Faktoren sein, die den Konsum und damit das Wachstum fördern. In den Schwellenländern sollten die Finanzmärkte auch durch Reformprogramme, einschließlich der Rentenreformen, unterstützt werden“, sagt Ygal Sebban, Schwellenländerexperte bei GAM.

Solide Staatsfinanzen

Als weiteres Pfund mit dem die Schwellenländer laut Sebban wuchern können, ist die sich stetig verbessernde Kreditqualität. Acht der zehn größten Schwellenländer verfügten derzeit über ein Investment-Grade-Rating, während es vor zwanzig Jahren nur vier von zehn waren. „Die Staatsverschuldung der Schwellenländer im Verhältnis zum BIP liegt deutlich unter der Hälfte des Niveaus der Industrieländer“, so der GAM-Experte weiter. Darüber hinaus dürften die derzeit hohen Realzinsen in vielen Schwellenländern (z. B. Brasilien mit etwa 7,6 Prozent, Südafrika mit 6,2 Prozent, Mexiko mit 5,2 Prozent) die Währungen der Schwellenländer und damit die künftigen Renditen von Schwellenländeraktien unterstützen.

Wachstumsgefälle nimmt zu

Da die Industrieländer möglicherweise vor einer Phase langsamen Wachstums am Ende eines Investitionszyklus stehen, dürfte laut Sebban das Wachstumsgefälle zwischen Schwellenländern und etablierten Volkswirtschaften vergrößern. In einer Welt mit geringem Wachstum werden Anleger nach Wachstumschancen suchen, die in den Schwellenländern reichlich vorhanden sind.

Niedrige Bewertungen und hohes Potenzial

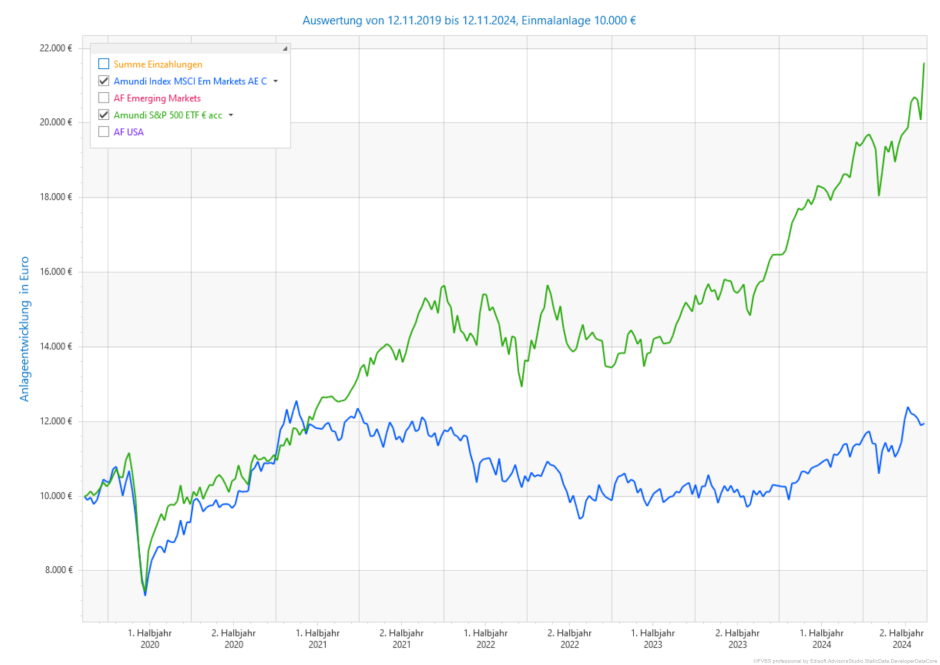

Schwellenländer haben sich laut dem GAM-Manager in den letzten zehn Jahren dramatisch schlechter entwickelt als etwa US-Aktien. Daher sind die Schwellenmärkte sehr günstig bewertet. Der MSCI Emerging Markets Index wird laut GAM derzeit mit einem Abschlag von über 40 Prozent im Vergleich zum S&P 500 gehandelt. Während das Kurs-Gewinn-Verhältnis (KGV) für den MSCI EM bei 12,6 liegt, notiert der S&P 500 bei 21,2 – ein erheblicher Unterschied, der Schwellenländer für Value-Anleger interessant macht. In den letzten 20 Jahren haben sich laut Sebban die Sektoren innerhalb der EM strukturell verändert. Heute spielen die Sektoren zyklische Konsumgüter und Technologie (zusammen etwa 37 Prozent des Index gegenüber nur 24 Prozent vor zwanzig Jahren) eine prominentere Rolle als in der Vergangenheit. Die Bedeutung der traditionellen Schwerpunkte wie Energie und Rohstoffe ist hingegen von 22 Prozent vor 20 Jahren auf heute nur noch elf Prozent gesunken.

Trump, Zölle und der US-Dollar

Das Comeback von Donald Trump könnte den Schwellenländern Herausforderungen durch höhere Zölle bringen, insbesondere für exportorientierte Länder wie China. „Die Vorgängerregierung von Präsident Trump war für ihre aggressive Haltung gegenüber Zöllen, insbesondere gegenüber China, bekannt, und während des laufenden Wahlkampfs setzte er diese Rhetorik fort. Könnte die Androhung von Zöllen genutzt werden, um eine Einigung zu erzielen? Immerhin hat Präsident Trump erklärt, er habe kein Problem damit, dass das chinesische Automobilunternehmen BYD eine Fabrik in Michigan eröffnet, da er die USA wieder industrialisieren und Arbeitsplätze für Arbeiter schaffen möchte. Präsident Trump erklärte auch seine Absicht, zusätzliche Zölle auf China zu erheben, falls China „Taiwan angreifen“ sollte. Daraus lässt sich schließen, dass die Zölle zu höheren Kosten für Exporteure aus Schwellenländern führen werden, die von der US-Nachfrage abhängig sind. Auf der anderen Seite könnten andere Exporteure aus Schwellenländern davon profitieren, dass Unternehmen ihre Lieferketten in Gebiete wie Südostasien und Lateinamerika verlagern“, erklärt Krishan Selva, Client Portfolio Manager bei Columbia Threadneedle.

US-Dollar als Knackpunkt

Eine weitere Unsicherheit besteht in der Stärke des US-Dollars. Sollte die Trump-Administration erneut auf Wachstumsmaßnahmen wie Steuersenkungen und höhere Staatsausgaben setzen, könnte der Dollar weiter aufwerten. Historisch gesehen wirkt sich laut Selva ein starker Dollar negativ auf die Schwellenmärkte aus, da sich ihre Finanzierungskosten erhöhen. Eine Abwertung der Währungen in betroffenen Ländern könnte jedoch neue Handelschancen eröffnen und diese Märkte wettbewerbsfähiger machen.

Chancen in China trotz Handelskonflikt

China bleibt einer der dynamischsten und derzeit attraktivsten Schwellenmärkte, trotz potenzieller Zölle und eines gespannten Verhältnisses zu den USA. Die chinesische Regierung hat in den letzten Monaten eine Reihe wirtschaftspolitischer Maßnahmen ergriffen, um die Wirtschaft anzukurbeln. Dazu zählen Zinssenkungen, eine Lockerung der Geldpolitik und gezielte Unterstützungsmaßnahmen im Immobiliensektor. Diese Maßnahmen könnten das BIP-Wachstum weiter ankurbeln und bieten Investoren attraktive Einstiegsgelegenheiten.

Konsum hat viel Potenzial

Der chinesische Konsumsektor, insbesondere zyklische Konsumgüter, ist laut Sebban ein vielversprechender Bereich, der vom wirtschaftlichen Aufschwung profitieren dürfte. Der Privatkonsum macht derzeit etwa 38 Prozent des BIP aus, ein vergleichsweise niedriger Wert, der jedoch das Potenzial hat, in den kommenden Jahren weiter zu steigen. Neben dem Konsumsektor bieten auch der Technologiebereich und der Markt für Elektrofahrzeuge attraktive Wachstumschancen, wie Unternehmen wie BYD zeigen.

„Der Verbrauch der privaten Haushalte macht in China etwa 38 Prozent des BIP aus, im Vergleich zu wesentlich höheren Werten in anderen Ländern – fast 70 Prozent in den USA, 50 Prozent in Deutschland, 60 Prozent in Indien – und wir gehen davon aus, dass der Anteil des Verbrauchs am BIP in China in den kommenden Jahren zunehmen wird“, sagt Sebban.

China ist in den meisten Depots untergewichtet

Viele Anleger haben laut GAM China nach wie vor deutlich untergewichtet. „Die China-Allokation in aktiven Fonds und Hedgefonds weltweit ist so niedrig wie nie zuvor. Ende August betrug die Allokation der Investmentfonds in chinesischen Aktien weltweit 5,1 Prozent. Privatanleger waren in der Zwischenzeit nur in sehr geringem Masse in China engagiert, da chinesische Aktien in den letzten Jahren deutlich zurückgeblieben sind. Seit der Ankündigung im September gab es jedoch ein starkes Interesse von chinesischen Kleinanlegern an der Eröffnung neuer Depots, und einzelne Anleger haben bereits begonnen, chinesische Aktien zu kaufen. Privatanleger haben nur sechs Prozent ihres Finanzvermögens in Aktien investiert, gegenüber 46 Prozent in Bankeinlagen. Dies ist ein ermutigendes Signal, und wir glauben, dass hier noch mehr kommen wird.“

Technologielastige Fonds liegen vorne

Im laufenden Jahr am besten geschlagen haben sich neben den Frontier Markets Fonds technologielastige Fonds wie der EM Digital Leaders Fonds, der EMQQ Emerging Markets Internet UCITS ETF oder auch der Morgan Stanley Investment Funds - Developing Opportunity Fund. Beim EM Digital Leaders Fonds ist Steffen Gruschka am Ruder. Der ex-DWS und ex-Hedgefondsmanager investiert bei dem Fonds in die Gewinner der Digitalisierung aus Schwellenländern. Sein Investmentansatz erweitert die „klassische“ Aktienanalyse um die Beurteilung der digitalen Reife eines Unternehmens. Das Anlageuniversum besteht aus drei Gruppen Unternehmen: Digital Transformation Leaders: Substanzstarke, etablierte Unternehmen mit einem hohen digitalen Reifegrad. Digital Business Leaders: Plattformunternehmen, die einen Großteil der Umsätze über digitale Kanäle erwirtschaften. Digital Enablers: Hochspezialisierte Domainleader, die die Digitalisierung der Welt ermöglichen. Im Portfolio befinden sich Titel wie Kaspi, Sea, Nu Holdings, Taiwan Semiconductor, Mercadolibre, BYD, Nebius Group, SHOPER S.A., Waterdrop Inc. oder auch D-MARKET Electronic Services. An den Namen sieht man schon, dass sich das Portfolio deutlich von den üblichen Schwellenländerfonds ab. Insgesamt gibt es gerade bei den Schwellenländerfonds sehr große Unterschiede bei den Portfolios. Daher lohnt eine Analyse. Zudem zahlt sich aktives Management meist aus. ETFs auf dem MSCI Emerging Markets gehören in der Regel nicht zu den Top-Performern

Fazit

Trotz der weiterhin zunehmenden Spannungen zwischen China gehört China in jedes Depot. Entweder über einen China Fonds oder globale Schwellenländerfonds inklusive China. Die ex-China Fonds sind insbesondere für Anleger eine gute Wahl, die ihre China-Quote selbst steuern möchten.

Übersicht über die besten Emerging Markets Fonds

| Name | ISIN | tgl. Perf. seit 1.1. | tgl. Perf. 1 Monat | tgl. Perf. 1 Jahr | tgl. Perf. 3 Jahre | tgl. Perf. 5 Jahre | Volatilität 3 Jahre |

|---|---|---|---|---|---|---|---|

| EM Digital Leaders R | DE000A2QK5J1 | 39,40% | 4,19% | 47,07% | -5,82% | 21,93% | |

| Templeton Frontier Markets Fund A (acc) USD | LU0390136736 | 27,56% | 2,44% | 32,60% | 21,70% | 49,88% | 12,71% |

| EMQQ Emerging Markets Internet UCITS ETF | IE00BFYN8Y92 | 26,42% | -1,91% | 29,34% | -23,12% | 18,04% | 33,46% |

| Morgan Stanley Developing Opportunity A | LU2091680145 | 26,25% | 1,20% | 29,46% | -12,84% | 18,24% | |

| East Capital (Lux) - Frontier Markets Fund A EUR | LU1125674454 | 25,45% | 3,07% | 29,87% | 18,77% | 57,31% | 12,77% |

| Xtrackers S&P Select Frontier Swap UCITS ETF 1C | LU0328476410 | 24,39% | 5,41% | 39,49% | 22,80% | 51,28% | 17,63% |

| T. Rowe Price Funds SICAV - Frontier Markets Equity Fund A | LU1079763535 | 24,16% | 3,03% | 29,52% | 13,51% | 55,53% | 12,48% |

| Carmignac Portfolio-Emerging Discovery A EUR acc | LU0336083810 | 24,11% | 0,40% | 28,95% | 3,65% | 34,26% | 12,37% |

| Neuberger Berman Emerging Markets Equity Fund USD Accumulating | IE00B3M56506 | 24,04% | 0,22% | 27,10% | -1,32% | 11,65% | 14,80% |

| NinetyOne GSF Emerging Markets Sustainable Equity Fund Z Acc EUR | LU2536488997 | 23,25% | -2,19% | 26,80% | |||

| Schroder ISF Frontier Markets Equity USD A thesaurierend | LU0562313402 | 23,20% | 2,77% | 28,92% | 34,84% | 77,86% | 13,19% |

| East Capital (Lux) - Global Emerging Markets Sustainable Fund A EUR | LU0212839673 | 22,11% | -0,66% | 27,07% | 2,65% | 43,01% | 14,26% |

| HSBC ETFs PLC - HSBC Emerging Markets Sustainable Equity UCITS ETF USD | IE00BKY59G90 | 21,88% | -0,92% | 25,02% | 4,92% | 12,89% | |

| Templeton BRIC Fund A (acc) USD | LU0229945570 | 21,77% | -1,86% | 21,52% | -5,58% | 10,39% | 17,26% |

| Berenberg Emerging Asia Focus Fund R A | LU2491195983 | 21,56% | 1,01% | 24,45% | |||

| HSBC GIF Frontier Markets A Cap | LU0666199749 | 21,08% | 2,43% | 27,49% | 42,97% | 91,59% | 12,39% |

| FAST - Emerging Markets Fund A-ACC-USD | LU0650957938 | 21,01% | -1,40% | 26,70% | -11,24% | 23,79% | 14,72% |

| GAM Sustainable Emerging Equity Ordinary EUR Acc | IE00B5VSGF43 | 20,53% | -0,31% | 40,53% | 14,47% | 41,20% | 16,61% |

| AXA IM Global Emerging Markets Equity QI B EUR | IE00B101K104 | 20,14% | -0,17% | 25,55% | 14,08% | 34,49% | 13,92% |

| Evli Emerging Frontier Fund B | FI4000066915 | 19,85% | 5,10% | 20,05% | 24,15% | 97,43% | 13,22% |

| Allianz Global Emerg. Mkts Equity Dividend - I - EUR | LU1254139196 | 19,61% | -0,63% | 24,99% | 18,96% | 51,57% | 12,85% |

| Vanguard ESG Emerging Markets All Cap Equity Index Fund GBP Cap | IE00BKV0VZ05 | 19,31% | 0,29% | 23,37% | 3,52% | 12,76% | |

| Allianz Emerging Markets Equity Opportunities - WT2 - EUR | LU1068093993 | 19,15% | -1,48% | 23,88% | 8,67% | 36,71% | 13,62% |

| iShares Edge MSCI EM Value Factor UCITS ETF USD (Acc) | IE00BG0SKF03 | 19,13% | -1,12% | 27,39% | 22,32% | 42,75% | 14,31% |

| DWS Advisors Emerging Markets Equities - Passive ID (EUR) | LU0666900674 | 18,83% | -2,08% | 21,28% | 1,68% | 25,27% | 12,46% |

| Allianz Best Styles Emerging Markets Equity - AT - EUR | LU1282651980 | 18,68% | -1,48% | 22,45% | 4,95% | 32,77% | 13,54% |

| Goldman Sachs Emerging Markets Equity Income P Cap EUR | LU0300631982 | 18,41% | -1,75% | 24,06% | 0,73% | 18,35% | 13,35% |

| Invesco FTSE RAFI Emerging Markets UCITS ETF | IE00B23D9570 | 18,38% | -1,79% | 23,96% | 15,92% | 31,12% | 13,03% |

| Mirabaud - Equities Global Emerging Markets A cp GBP | LU0874829103 | 18,37% | -1,70% | 24,08% | -5,27% | 15,60% | 15,95% |

| SPDR S&P Emerging Markets Dividend ETF | IE00B6YX5B26 | 18,23% | 1,47% | 22,71% | 15,38% | 9,82% | 14,16% |

| Robeco QI Emerging Markets Sustainable Active Equities F EUR | LU1648457023 | 18,12% | -1,83% | 24,64% | 16,08% | 37,90% | 12,84% |

| SEB Emerging Marketsfond | SE0000984155 | 18,05% | -1,06% | 24,54% | 11,43% | 14,23% | |

| Vanguard FTSE Emerging Markets UCITS ETF | IE00B3VVMM84 | 18,03% | -1,11% | 22,19% | 4,40% | 26,51% | 12,57% |

| Vanguard ESG Emerging Markets All Cap UCITS ETF USD Acc | IE000KPJJWM6 | 17,78% | -0,22% | 22,28% | |||

| Quoniam Funds Selection SICAV - Emerging Markets Equities MinRisk | LU0489951870 | 17,75% | -0,37% | 19,58% | 18,97% | 34,88% | 9,74% |

| Allianz GEM Equity High Dividend AT EUR | LU0293313325 | 17,74% | -0,88% | 23,23% | 15,43% | 43,39% | 12,98% |

| Heptagon Fund - Driehaus Emerging Markets Sustainable Equity Fund A | IE00B76BMG52 | 17,69% | 0,50% | 22,73% | 39,89% | 11,34% | |

| River and Mercantile Emerging Market ILC Equity Fund EB USD acc | LU1692110783 | 17,61% | -1,54% | 21,54% | 6,16% | 32,78% | 13,45% |

| Xtrackers MSCI Emerging Markets ESG UCITS ETF 1C | IE00BG370F43 | 17,52% | -2,37% | 20,57% | -7,18% | 9,07% | 15,85% |

| AB SICAV I-Emerging Markets Low Volatility Equity Portfolio A USD | LU1005412207 | 17,50% | -2,30% | 21,59% | 10,20% | 24,22% | 12,36% |

| Raiffeisen-Nachhaltigkeit-EmergingMarkets-Aktien (R) A | AT0000A1TB42 | 17,39% | 0,90% | 20,85% | -6,32% | 14,30% | 12,44% |

| Robeco QI Emerging Markets Active Equities D EUR | LU0329355670 | 17,35% | -1,98% | 24,10% | 18,80% | 47,79% | 12,95% |

| Flossbach von Storch - Global Emerging Markets Equities R | LU1012015118 | 17,25% | 0,63% | 22,45% | -7,26% | 27,52% | 12,84% |

| Edmond de Rothschild Fund Strategic Emerging A-EUR | LU1103293855 | 17,18% | -1,76% | 21,57% | -13,73% | 3,46% | 13,97% |

| SEB Sicav 1 - Emerging Markets C (USD) | LU0037256269 | 17,13% | -0,98% | 23,54% | 4,99% | 9,55% | 13,72% |

| Candriam Equities L Emerging Markets C | LU0056052961 | 17,10% | -1,66% | 20,23% | -14,66% | 17,77% | 13,24% |

| Amundi PEA MSCI Emerging Asia ESG Leaders UCITS ETF | FR0013412012 | 17,10% | -1,64% | 19,45% | -2,89% | 23,80% | 16,25% |

| FSSA Global Emerging Markets Focus VI EUR Acc | IE00BGV7N136 | 16,92% | -0,52% | 20,81% | 9,52% | 24,01% | 14,42% |

| SSgA Enhanced Emerging Markets Equity Fund I USD | LU0446997610 | 16,83% | -1,47% | 22,37% | 6,55% | 29,96% | 13,59% |

| Wellington Emerging Markets Research Equity Fund - S USD ACC | LU1054168221 | 16,80% | -1,48% | 19,76% | -9,17% | 11,06% | 13,77% |

| BNP Paribas Easy MSCI Emerging ESG Filtered Min TE | LU1291097779 | 16,67% | 0,03% | 21,73% | -0,03% | 21,55% | 13,77% |

| Schroder ISF BIC (Brazil India China) A Accumulation USD | LU0228659784 | 16,63% | -3,53% | 14,34% | -22,13% | -8,32% | 15,42% |

| Goldman Sachs Emerging Markets Equity ESG Portfolio Base Acc | LU1876476067 | 16,53% | -2,45% | 17,98% | -16,69% | 14,20% | 14,31% |

| Amundi MSCI Emerging Markets UCITS ETF EUR (A) | LU1681045370 | 16,47% | -0,27% | 21,80% | 2,09% | 23,62% | 13,65% |

| Amundi Index MSCI Emerging Markets UCITS ETF DR (D) | LU1737652583 | 16,41% | -0,19% | 21,63% | 1,66% | 21,31% | 13,61% |

| Allianz Emerging Markets Equity SRI X7 (EUR) | LU2052517237 | 16,32% | -1,67% | 20,58% | 9,35% | 27,46% | 13,71% |

| Amundi Prime Emerging Markets UCITS ETF DR (A) | LU2300295123 | 16,30% | -0,09% | 21,67% | 5,41% | 12,93% | |

| GuardCap Emerging Markets Equity Fund I USD Cap | IE00BSJCNT20 | 16,26% | 3,01% | 18,35% | -8,04% | 17,16% | 15,92% |

| ERSTE Stock EM Global EUR R01 (A) (EUR) | AT0000680962 | 16,24% | -0,47% | 20,26% | -2,40% | 21,11% | 12,53% |

| DNB Fund - Brighter Future Fund Retail A (USD) | LU0090738252 | 16,14% | -0,48% | 18,89% | -7,92% | 15,36% | 14,24% |

| Amundi MSCI Emerging Markets III UCITS ETF EUR Acc | FR0010429068 | 16,13% | -0,29% | 21,38% | 1,10% | 21,90% | 13,72% |

| UBS ETF (LU) MSCI Emerging Markets Socially Responsible UCITS ETF (USD) A-acc | LU1048313974 | 16,12% | -1,96% | 19,94% | -2,80% | 18,24% | 14,08% |

| KBC Equity Fund Emerging Markets Responsible Investing Classic (thes.) | BE6260699283 | 16,08% | 0,31% | 19,57% | -66,62% | -63,38% | 39,65% |

| Amundi MSCI Emerging Markets II UCITS ETF Dist | LU2573966905 | 16,06% | -0,34% | 25,74% | 3,18% | 21,86% | 13,76% |

| Lazard Emerging Markets Equity Advantage Fund A Dist EUR | IE00091Q14C4 | 16,05% | -2,78% | 19,16% | |||

| Swiss Rock (Lux) Sicav - Emerging Equity/Aktien Schwellen. A | LU0337168263 | 16,01% | 0,36% | 20,55% | 3,57% | 27,01% | 11,86% |

| HSBC MSCI Emerging Markets Value ESG UCITS ETF Acc | IE000NVVIF88 | 15,96% | -1,89% | 23,31% | |||

| Xtrackers Emerging Markets Net Zero Pathway Paris Aligned UCITS ETF 1C | IE000TZT8TI0 | 15,88% | -1,77% | 20,45% | |||

| MFS Meridian Funds - Emerging Markets Equity Fund A1EUR | LU0219423836 | 15,75% | -2,82% | 18,58% | 0,06% | 7,62% | 14,27% |

| JPMorgan Funds - Emerging Markets Diversified Equity Plus Fund A (acc) EUR | LU2190025218 | 15,57% | -2,53% | 19,91% | 0,11% | 13,93% | |

| Goldman Sachs Emerging Markets Equity Portfolio Base acc | LU0234572377 | 15,51% | -1,66% | 17,68% | -17,42% | 12,08% | 14,07% |

| State Street Sustainable Climate Emerging Markets Enhanced Equity I | LU0810595867 | 15,47% | -1,36% | 21,38% | 2,71% | 23,71% | 13,43% |

| Allianz Emerging Markets Equity SRI IT (EUR) | LU2034159405 | 15,45% | -1,74% | 19,62% | 6,94% | 21,96% | 13,50% |

| Amundi Index MSCI Emerging ESG Broad CTB - UCITS ETF DR (C) | LU2109787049 | 15,43% | -0,46% | 19,93% | -1,43% | 13,70% | |

| Pictet - Emerging Markets Index - P dy USD | LU0208606003 | 15,39% | 0,23% | 19,28% | -0,61% | 19,63% | 12,63% |

| UBS (Lux) Institutional SICAV - Emerging Markets Equity Passive AA Acc USD | LU0322728865 | 15,39% | -0,11% | 20,41% | -0,39% | 20,02% | 13,51% |

| William Blair SICAV - Emerging Markets Growth I $ | LU0222530932 | 15,26% | -0,45% | 18,65% | -16,55% | 24,34% | 12,85% |

| Pictet Global Multi Asset Themes P EUR | LU0725974439 | 15,24% | 2,94% | 21,26% | 7,04% | 13,75% | 12,29% |

| Aviva Investors - Global Emerging Markets Core Fund - B USD | LU0047882062 | 15,23% | -3,14% | 19,48% | -0,24% | 9,23% | 14,22% |

| Swisscanto (CH) Equity Fund Sustainable Emerging Markets AA USD | CH0004661267 | 14,92% | -1,01% | 19,55% | 1,71% | 19,98% | 12,45% |

| UniEM Global | LU0115904467 | 14,91% | 0,44% | 18,54% | -11,85% | -1,71% | 13,25% |

| BNP Paribas Emerging Equity Classic Cap | LU0823413587 | 14,90% | -0,68% | 17,54% | -6,43% | -5,20% | 13,37% |

| AMUNDI FUNDS NEW SILK ROAD A EUR Acc | LU1941681014 | 14,89% | -1,46% | 18,34% | -6,43% | 31,42% | 13,86% |

| Lazard Global Active F. plc - Emerging Markets Equity Fund A Dist USD | IE00B1L6MF22 | 14,83% | -3,22% | 20,06% | 20,28% | 22,94% | 12,98% |

| DWS Global Emerging Markets Equities ND | DE0009773010 | 14,79% | 0,30% | 17,42% | -1,34% | 13,55% | 13,18% |

| Fidelity Funds - Institutional Emerging Markets Equity Fund I-ACC-USD | LU0261963887 | 14,68% | 0,14% | 19,53% | -17,14% | 13,10% | 14,63% |

| Vanguard Emerging Markets Stock Index Fund Investor EUR | IE0031786142 | 14,67% | -1,72% | 19,56% | -0,62% | 21,42% | 13,60% |

| Amundi MSCI Emerging ESG Leaders - UCITS ETF DR (C) | LU2109787551 | 14,65% | -1,35% | 18,69% | -6,85% | 13,97% | |

| Candriam Sustainable - Equity Emerging Markets - C Part (C) | LU1434523954 | 14,57% | -2,37% | 15,58% | -21,12% | 11,14% | 13,37% |

| Amundi PEA MSCI Emerging Markets ESG Leaders UCITS ETF - EUR (C/D) | FR0013412020 | 14,50% | -1,41% | 18,27% | -1,92% | 18,61% | 13,79% |

| RAM (Lux) Systematic Funds - Emerging Markets Equities ( EUR) L | LU0424800612 | 14,50% | -0,50% | 19,83% | 15,11% | 50,53% | 11,63% |

| Pro Fonds (Lux) Emerging Markets B | LU0048423833 | 14,42% | 0,25% | 17,84% | 0,17% | 7,27% | 11,26% |

| Magna Umbrella - Magna New Frontiers Fund R EUR | IE00B68FF474 | 14,38% | 0,80% | 20,13% | 18,00% | 66,82% | 12,30% |

| Invesco Emerging Markets Equity Fund A-AD | LU1775952507 | 14,36% | -2,25% | 18,31% | 6,29% | 42,37% | 14,06% |

| State Street Global Emerging Markets Index Equity Fund I | LU1159235958 | 14,35% | -1,80% | 19,81% | -1,90% | 19,78% | 13,76% |

| JPM Middle East, Africa and Emerging Europe Opportunities A Acc EUR | LU2539333562 | 14,31% | 3,15% | 18,10% | |||

| L&G Quality Equity Dividends ESG Exclusions Emerging Markets UCITS ETF USD Dist | IE00BMYDMC42 | 14,29% | -0,43% | 20,18% | 23,35% | 11,23% | |

| iShares MSCI Emerging Markets UCITS ETF USD (Acc) | IE00B4L5YC18 | 14,28% | -1,94% | 19,59% | -0,42% | 21,22% | 13,59% |

| Xtrackers MSCI Emerging Markets UCITS ETF 1C | IE00BTJRMP35 | 14,25% | -1,96% | 19,58% | -0,73% | 20,79% | 13,61% |

| DWS Invest ESG Global Emerging Markets Equities FC | LU1984219524 | 14,25% | -0,61% | 17,79% | 0,24% | 28,13% | 13,75% |

| BF I - BlackRock Advantage Emerging Markets Equity Fund Class A Accumulating USD | IE00BDDRH854 | 14,21% | -2,30% | 18,56% | -2,31% | 15,22% | 13,48% |

| Amundi Index MSCI EM Asia SRI PAB - UCITS ETF DR (D) | LU2300294589 | 14,20% | -1,11% | 14,27% | -14,82% | 16,07% | |

| Danske Invest - Global Emerging Markets A | LU0085580271 | 14,18% | -1,72% | 19,50% | -10,61% | 11,24% | 14,59% |

| iShares MSCI Emerging Markets Consumer Growth UCITS ETF USD Acc | IE00BKM4H197 | 14,13% | -1,73% | 16,59% | -9,66% | 13,72% | 16,35% |

| SPDR® MSCI Emerging Markets ETF | IE00B469F816 | 14,12% | -1,90% | 19,41% | -0,51% | 21,22% | 13,46% |

| Sparinvest SICAV Ethical Emerging Markets Value EUR I | LU0760184134 | 14,11% | -2,99% | 18,84% | 17,19% | 43,15% | 11,95% |

| KBC Equity Fund Emerging Markets (auss.) | BE0152251584 | 14,09% | 0,62% | 18,21% | -4,05% | 1,21% | 15,21% |

| HSBC GIF Global Emerging Markets Equity AC | LU0164872284 | 14,09% | -2,53% | 19,51% | -9,95% | 16,64% | 15,13% |

| iShares MSCI EM IMI ESG Screened UCITS ETF USD (Acc) | IE00BFNM3P36 | 14,08% | -1,92% | 19,47% | -0,06% | 26,70% | 13,34% |

| GQG Partners Emerging Markets Equity Fund A USD Acc | IE00BYW5Q130 | 14,06% | -0,46% | 22,24% | |||

| UBS-ETFs plc - MSCI Emerging Markets SF UCITS ETF (USD) A-acc | IE00B3Z3FS74 | 14,02% | -2,05% | 19,36% | -0,47% | 20,90% | 13,52% |

| Mediolanum Best Brands - Emerging Markets Collection L - A | IE0005380518 | 13,99% | -0,11% | 16,77% | -8,10% | 5,22% | 13,13% |

| Xtrackers MSCI Emerging Markets Swap UCITS ETF 1C | LU0292107645 | 13,99% | -2,06% | 19,27% | -1,13% | 19,37% | 13,54% |

| Amundi Index MSCI Emerging Markets SRI PAB - UCITS ETF DR (C) | LU1861138961 | 13,96% | -0,74% | 15,83% | -6,68% | 14,31% | 13,72% |

| Artemis Funds (Lux) - SmartGARP Global Emerging Markets Equity I USD Acc | LU1846577242 | 13,93% | -1,34% | 18,37% | 16,86% | 37,53% | 12,73% |

| Fidelity MSCI Emerging Markets Index Fund P-ACC-USD | IE00BYX5M039 | 13,91% | -1,84% | 18,88% | -1,31% | 19,88% | 13,34% |

| L&G Emerging Markets ESG Exclusions Paris Aligned UCITS ETF USD Accumulating | IE000CBYU7J5 | 13,91% | -1,31% | 18,80% | |||

| Invesco MSCI Emerging Markets UCITS ETF | IE00B3DWVS88 | 13,91% | -2,07% | 19,19% | -1,18% | 19,69% | 13,54% |

| abrdn SICAV I - Emerging Markets Ex China Equity Fund A Acc USD | LU1581387781 | 13,89% | -1,13% | 18,79% | -13,76% | 8,69% | 13,51% |

| J O Hambro Capital Management Global Emerging Markets Opportunities Fund A GBP | IE00B4002N46 | 13,80% | -1,26% | 18,98% | 8,63% | 33,87% | 12,53% |

| Magna Umbrella - Magna Emerging Markets Income and Growth Fund R acc | IE00B670Y570 | 13,78% | -0,39% | 23,97% | 7,31% | 17,80% | 13,78% |

| iShares MSCI EM ESG Enhanced UCITS ETF USD (Acc) | IE00BHZPJ239 | 13,68% | -2,02% | 18,19% | -4,45% | 18,33% | 13,77% |

| Franklin MSCI Emerging Market Paris Aligned Climate UCITS ETF | IE000QLV3SY5 | 13,68% | -2,44% | 18,90% | |||

| UBS (Irl) ETF plc - MSCI Emerging Markets Climate Paris Aligned UCITS ETF (USD) | IE00BN4Q1675 | 13,67% | -2,64% | 19,58% | -4,95% | 13,43% | |

| iShares MSCI Emerging Markets SRI UCITS ETF USD (Acc) | IE00BYVJRP78 | 13,60% | -1,75% | 15,84% | -7,32% | 15,39% | 13,63% |

| iShares Core MSCI EM IMI UCITS ETF USD Acc | IE00BKM4GZ66 | 13,60% | -1,86% | 19,12% | 1,43% | 26,40% | 13,16% |

| Schroder ISF Emerging Markets USD A Acc | LU0106252389 | 13,58% | -1,78% | 17,34% | -8,40% | 13,48% | 13,31% |

| Schroder ISF Emerging Asia USD A Acc | LU0181495838 | 13,56% | -3,36% | 14,27% | -9,15% | 28,75% | 15,66% |

| SPDR® MSCI Emerging Markets Climate Paris Aligned UCITS ETF (Acc) | IE00BYTH5263 | 13,56% | -2,58% | 19,72% | |||

| Goldman Sachs Emerging Markets Enhanced Index Sustainable Equity P Cap USD | LU0051128774 | 13,43% | -1,70% | 17,62% | -3,35% | 18,54% | 13,36% |

| Janus Henderson Emerging Markets Fund A2 EUR | LU0113993801 | 13,41% | -0,24% | 14,26% | -11,54% | 16,29% | 12,97% |

| Challenge Funds - Challenge Emerging Markets Equity Fund L - A | IE0004878744 | 13,41% | 0,37% | 17,08% | -3,05% | 8,60% | 12,10% |

| Russell Investment Company plc - Emerging Markets Equity Fund A Acc | IE0003507054 | 13,41% | -1,69% | 17,70% | -5,38% | 14,09% | 13,97% |

| iShares Edge MSCI EM Minimum Volatility UCITS ETF USD (Acc) | IE00B8KGV557 | 13,40% | -0,43% | 17,42% | 7,39% | 19,67% | 8,62% |

| Templeton Emerging Markets Fund A (Ydis) USD | LU0029874905 | 13,35% | -2,78% | 16,50% | -1,05% | 16,39% | 15,59% |

| Deka MSCI Emerging Markets UCITS ETF | DE000ETFL342 | 13,21% | -2,13% | 18,34% | -3,23% | 15,96% | 13,50% |

| Nordea 1 - Emerging Stars Equity Fund BP-EUR | LU0602539867 | 13,21% | -1,97% | 17,71% | -21,19% | 9,30% | 15,38% |

| iShares Emerging Markets Equity Index Fund A2 USD | LU0836513183 | 13,21% | -2,14% | 18,39% | -1,33% | 18,60% | 13,64% |

| M&G (Lux) Global Emerging Markets Fund US Dollar A Accumulation | LU1670624664 | 13,21% | -3,73% | 18,95% | 15,12% | 25,71% | 14,23% |

| HSBC MSCI Emerging Markets Climate Paris Aligned UCITS ETF USD | IE000FNVOB27 | 13,20% | -2,40% | 18,79% | |||

| Schroder ISF Global Emerging Market Opportunities EUR A Acc | LU0279459456 | 13,18% | -0,96% | 17,91% | -6,27% | 20,94% | 14,54% |

| Dimensional Funds - Emerging Markets Large Cap Core Equity Fund EUR Dis | IE00BWGCG943 | 13,09% | -1,80% | 17,74% | 10,34% | 31,36% | 13,70% |

| Federated Hermes Global Emerging Markets Equity Fund R EUR Dist | IE00BWTNM412 | 13,08% | -1,51% | 16,72% | -13,17% | 6,42% | 14,84% |

| Morgan Stanley Sustainable Emerging Markets Equity Fund (USD) A | LU0073229840 | 13,05% | -2,18% | 20,19% | -5,54% | 15,73% | 14,49% |

| AXA World Funds - Emerging Markets Responsible Equity QI A Cap € | LU0327689542 | 12,98% | -1,92% | 17,18% | -10,11% | 6,83% | 13,60% |

| UBS (L) FS - MSCI Emerging Markets UCITS ETF (USD) A-dis | LU0480132876 | 12,97% | -1,90% | 18,10% | -2,75% | 17,95% | 13,50% |

| Alger Emerging Markets Fund A USD | LU0242100229 | 12,96% | -0,28% | 15,93% | -21,58% | 12,60% | 15,07% |

| KBI Emerging Markets Equity Fund A EUR | IE00B54XT577 | 12,89% | -0,72% | 15,72% | 1,79% | 17,40% | 13,14% |

| DWS Invest Emerging Markets Top Dividend LC | LU0329760002 | 12,87% | -1,77% | 17,17% | -1,28% | 9,41% | 12,93% |

| Eurizon Fund - Equity Emerging Markets LTE - Z EUR acc | LU0457148020 | 12,87% | -0,55% | 17,47% | -4,34% | 15,39% | 13,61% |

| JPM Glob Emerging Markets Research Enhanced Index Equity (ESG) ETF - USD (acc) | IE00BF4G6Z54 | 12,84% | -1,94% | 17,33% | -3,80% | 19,14% | 13,83% |

| Vontobel Fund - mtx Sustainable Emerging Markets Leaders A USD | LU0571085330 | 12,81% | -1,51% | 15,35% | -11,94% | 3,52% | 16,04% |

| WisdomTree Emerging Markets ex-State-Owned Enterprises UCITS ETF USD Acc | IE00BM9TSP27 | 12,78% | -1,70% | 18,54% | -7,68% | 14,20% | |

| Invesco MSCI Emerging Markets ESG Climate Paris Aligned UCITS ETF Acc | IE000PJL7R74 | 12,72% | -1,86% | 16,86% | |||

| Fidelity Funds - Emerging Markets Fund A-Euro | LU0307839646 | 12,71% | -1,16% | 16,68% | -19,52% | 6,81% | 14,52% |

| ODDO BHF Emerging Markets CRW-EUR | LU0632979331 | 12,67% | -2,01% | 15,01% | 2,85% | 23,41% | 12,86% |

| HSBC MSCI Emerging Markets UCITS ETF | IE00B5SSQT16 | 12,65% | -2,65% | 17,57% | -2,09% | 18,52% | 13,41% |

| GAM Multistock - Emerging Markets Equity C USD | LU1112790479 | 12,61% | -0,73% | 18,25% | -7,97% | 13,62% | 14,64% |

| Dimensional Funds - Emerging Markets Value Fund USD Acc | IE00B0HCGS80 | 12,52% | -2,05% | 18,15% | 17,63% | 37,96% | 11,88% |

| Robeco QI Emerging Conservative Equities D EUR | LU0582533245 | 12,44% | -1,65% | 17,82% | 19,52% | 24,89% | 7,91% |

| Dimensional Emerging Markets Sustainability Core Equity Fund EUR Acc | IE00BLCGQT35 | 12,43% | -1,84% | 16,48% | |||

| Capital Group New World Fund (LUX) B USD | LU1481180195 | 12,36% | -1,29% | 16,73% | -1,39% | 32,14% | 11,74% |

| AB FCP I-Emerging Markets Growth Portfolio A USD | LU0040709171 | 12,33% | -2,71% | 17,41% | -10,68% | 13,39% | 15,12% |

| Dimensional Funds - Emerging Markets Core Equity Fund EUR Income | GB00BR4R5445 | 12,32% | -1,22% | 17,45% | 16,76% | 43,24% | 12,76% |

| Goldman Sachs Emerging Markets CORE® Equity Portfolio - Base Close Acc | LU0313355587 | 12,20% | -2,52% | 16,42% | 0,64% | 24,80% | 13,49% |

| DWS Invest Emerging Markets Top Dividend ND | LU1054328791 | 12,14% | -1,83% | 16,30% | -3,46% | 6,00% | 12,92% |

| Invesco MSCI Emerging Markets ESG Universal Screened UCITS ETF Acc | IE00BMDBMY19 | 12,14% | -1,55% | 16,67% | -3,37% | 13,42% | |

| T. Rowe Price Funds SICAV - Emerging Markets Discovery Equity Fund A | LU1244138183 | 12,06% | -1,70% | 18,03% | 3,65% | 19,08% | 12,44% |

| Amundi MSCI Emerging Ex China UCITS ETF Acc | LU2009202107 | 12,03% | 0,06% | 21,43% | 11,37% | 26,16% | 13,99% |

| Eurizon Fund - Equity Emerging Markets Smart Volatility - Z EUR acc | LU0335979323 | 11,90% | -0,76% | 16,34% | -5,13% | 8,29% | 12,46% |

| Templeton Emerging Markets Smaller Companies Fund A (acc) USD | LU0300738514 | 11,89% | -1,10% | 17,37% | 6,89% | 43,16% | 11,89% |

| Fidelity Sustainable Research Enhanced Emerging Markets Equity UCITS ETF Acc USD | IE00BLRPN388 | 11,87% | -2,51% | 16,22% | -5,37% | 13,58% | |

| Morgan Stanley Emerging Leaders Equity A | LU0815263628 | 11,77% | -0,06% | 18,31% | -22,61% | 38,41% | 14,68% |

| Baillie Gifford Worldwide Emerging Markets Leading Companies Fund A EUR Acc | IE00BK5TW610 | 11,72% | -3,09% | 18,04% | -12,05% | 19,41% | 17,30% |

| Amundi Funds Emerging Europe Middle East and Africa - A EUR (C) | LU1882447425 | 11,54% | 1,65% | 18,21% | -4,42% | 7,48% | 15,75% |

| Franklin Emerging Markets UCITS ETF | IE00BF2B0K52 | 11,44% | -1,69% | 17,19% | 6,48% | 13,50% | 11,00% |

| State Street Emerging Markets Opportunities Equity Fund P EUR | LU2373031488 | 11,40% | -1,13% | 16,60% | |||

| UBS (Irl) Investor Selection PLC UBS Global Emerging Markets Opportunity I-1 USD | IE00B5BGP398 | 11,32% | 1,10% | 16,27% | -11,49% | 8,00% | 15,27% |

| JPM Emerging Markets Dividend A (acc) - USD | LU0862449427 | 11,13% | -2,41% | 16,67% | 4,10% | 30,27% | 12,34% |

| Redwheel Next Generation Emerging Markets Equity Fund B USD | LU1965309757 | 11,12% | 0,46% | 20,90% | 133,72% | 10,54% | |

| AB FCP II-Emerging Markets Value Portfolio A USD | LU0474345724 | 11,10% | -3,02% | 14,46% | 2,55% | 20,72% | 14,91% |

| CT (Lux) Responsible Global Emerging Markets Equity A Inc USD | LU0153359632 | 11,10% | 2,47% | 16,12% | -7,47% | 1,02% | 13,49% |

| Barings Global Emerging Markets Fund Class A USD Inc | IE0000838304 | 11,09% | -3,40% | 16,25% | -1,23% | 10,40% | 14,89% |

| Eurizon Fund - Equity Emerging Markets Smart Volatility - R EUR acc | LU0090981274 | 10,98% | -0,84% | 15,22% | -7,92% | 2,94% | 12,46% |

| Robeco Emerging Markets Equities D EUR | LU0187076913 | 10,91% | -2,49% | 16,20% | 0,50% | 19,68% | 14,46% |

| William Blair SICAV - Emerging Markets Leaders Fund I USD | LU0612811850 | 10,80% | -1,59% | 14,79% | -15,28% | 7,11% | 12,92% |

| UBS (Lux) Fund Solutions - MSCI Emerging Markets ex China UCITS ETF USD A Acc | LU2050966394 | 10,75% | -1,16% | 19,89% | |||

| iShares MSCI EM ex-China UCITS ETF USD (Acc) | IE00BMG6Z448 | 10,70% | -1,21% | 19,98% | 9,96% | 13,93% | |

| BNY Mellon Emerging Equity Income Fund EUR A Inc | IE00B752P046 | 10,53% | -1,47% | 15,34% | -14,93% | 35,75% | 13,04% |

| Deka-Global ConvergenceAktien CF | LU0271177163 | 10,51% | -3,43% | 14,85% | -9,81% | 9,56% | 13,62% |

| BL - Equities Emerging Markets B USD | LU2292333197 | 10,49% | -1,55% | 13,24% | -4,49% | 13,58% | |

| Amundi MSCI Emerging ex China ESG Leaders Select UCITS ETF DR (A) | LU2345046655 | 10,37% | -0,73% | 18,83% | 1,82% | 12,81% | |

| MFS Meridian Funds - Emerging Markets Equity Research Fund A1USD | LU2271365293 | 10,29% | -2,74% | 12,61% | -6,58% | 14,31% | |

| Jupiter AM Series - Jupiter Global Emerging Markets Focus Fund L (USD) Acc | IE00B53SVZ72 | 10,29% | -0,37% | 17,69% | -6,76% | 24,14% | 13,87% |

| PineBridge Global Emerging Markets Focus Equity Fund A USD Acc | IE00B0JY6N72 | 10,21% | -0,62% | 14,89% | -12,54% | 18,51% | 14,72% |

| UBAM - Positive Impact Emerging Equity AC USD (Thesaurierung) | LU2051758147 | 10,10% | -0,22% | 12,29% | -13,34% | 11,43% | |

| Nordea 1 - Emerging Stars ex China Equity Fund BF-EUR | LU2621829329 | 10,10% | -0,82% | 20,98% | |||

| Evli GEM Fund - B Acc EUR | FI4000153697 | 10,02% | -0,88% | 17,61% | 9,59% | 41,92% | 12,71% |

| Dimensional Funds - Emerging Markets Targeted Value USD Acc | IE00B1W6DN61 | 9,92% | -1,32% | 14,92% | 15,02% | 49,27% | 11,31% |

| Canada Life Aktien Zukunftsmärkte II | IE00B0YVMT12 | 9,86% | -0,26% | 14,83% | 10,87% | 44,96% | 10,20% |

| Schroder ISF Global Emerging Markets Smaller Companies A Acc | LU1098400762 | 9,85% | -1,67% | 20,01% | 7,29% | 46,80% | 12,01% |

| JPM Emerging Markets Sustainable Equity A (acc) - USD | LU2051468812 | 9,70% | -0,53% | 14,42% | -13,52% | 13,44% | |

| Allspring (Lux) Worldwide Fund - Emerging Markets Equity Class A USD | LU0541501648 | 9,65% | -2,48% | 12,98% | -11,24% | 4,39% | 13,34% |

| AMUNDI FUNDS EMERGING MARKETS EQUITY FOCUS - A EUR (C) | LU0552028184 | 9,64% | -2,44% | 12,92% | -8,64% | 14,91% | 13,19% |

| Redwheel Global Emerging Markets Fund A EUR | LU1324053104 | 9,59% | 0,05% | 13,51% | -17,87% | 13,39% | 17,62% |

| HSBC GIF BRIC Equity AC | LU0449509016 | 9,46% | -3,03% | 11,94% | -23,15% | -14,91% | 15,16% |

| GS&P Fonds Schwellenländer-Unterfonds R | LU0077884368 | 9,42% | -2,87% | 9,82% | -3,84% | 1,13% | 13,52% |

| Fiera Oaks EM Select Fund A EUR Acc Series 1 | IE00BKTNQ673 | 9,34% | -0,75% | 16,52% | 30,97% | 12,37% | |

| Fidelity Emerging Markets Quality Income UCITS ETF Acc USD | IE00BYSX4846 | 9,25% | -2,81% | 16,69% | -1,40% | 20,19% | 13,83% |

| Schroder ISF QEP Global Emerging Markets USD A Acc | LU0747139391 | 9,25% | -2,76% | 13,15% | -7,81% | 8,75% | 12,84% |

| HSBC GIF BRIC Markets Equity AC | LU0254981946 | 9,23% | -3,04% | 11,69% | -23,11% | -14,74% | 15,08% |

| JSS Sustainable Equity - Systematic Emerging Markets P USD dist | LU0068337053 | 9,00% | -0,50% | 12,72% | -15,66% | -19,43% | 16,26% |

| UBS (Lux) Equity Fund - Emerging Markets Sustainable Leaders (USD) P-acc | LU0106959298 | 8,99% | -1,52% | 14,06% | -18,61% | 2,04% | 15,61% |

| Nordea 1 - Emerging Stars ex China Equity Fund BP-USD | LU2528868008 | 8,99% | -0,81% | 19,64% | |||

| SPDR® MSCI Emerging Markets Small Cap ETF | IE00B48X4842 | 8,86% | -1,59% | 14,82% | 12,66% | 62,43% | 12,23% |

| Pictet - Emerging Markets-P USD | LU0130729220 | 8,84% | -2,40% | 14,92% | -19,89% | 4,42% | 15,10% |

| BNP PARIBAS EASY MSCI EMERGING MARKETS SRI UCITS ETF EUR D | LU1659681313 | 8,82% | -3,13% | 13,15% | -4,96% | 19,79% | 12,52% |

| Amundi Funds Emerging World Equity - A USD (C) | LU0347592197 | 8,81% | -2,04% | 12,40% | -7,00% | 13,36% | 12,66% |

| JPM Emerging Markets Opportunities Fund A (acc) - USD | LU0431992006 | 8,78% | -2,39% | 13,02% | -15,36% | 0,73% | 14,33% |

| Templeton Emerging Markets Sustainability Fund A (acc) USD | LU2213486215 | 8,59% | -2,16% | 10,33% | -9,13% | 13,93% | |

| Goldman Sachs Emerging Markets Ex-China Equity Portfolio Base Acc USD | LU2438695442 | 8,51% | -1,05% | 15,14% | |||

| MOBIUS SICAV - MOBIUS Emerging Markets Fund Retail D EUR | LU1846739917 | 8,31% | 0,78% | 13,71% | -3,04% | 57,69% | 17,20% |

| First Trust GF - First Trust Emerging Markets AlphaDEX® UCITS ETF Class A USD | IE00B8X9NX34 | 8,26% | -0,37% | 14,24% | 7,28% | 17,35% | 14,10% |

| abrdn SICAV I - Emerging Markets Equity Fund A Acc USD | LU0132412106 | 8,22% | -2,38% | 12,79% | -17,41% | 4,23% | 13,15% |

| Danske Invest - Global Emerging Markets Small Cap A | LU0292126785 | 8,10% | -0,62% | 17,47% | 4,74% | 48,96% | 13,91% |

| DekaLuxTeam-EmergingMarkets | LU0350482435 | 7,70% | -1,77% | 11,12% | -15,20% | 0,85% | 13,92% |

| abrdn SICAV I - Emerging Markets Smaller Companies Fund A Acc USD | LU0278937759 | 7,65% | -0,87% | 17,07% | 5,09% | 52,54% | 13,87% |

| JPM Emerging Markets Equity A (dist) - USD | LU0053685615 | 7,56% | -1,27% | 12,22% | -18,77% | 6,23% | 13,91% |

| Capital Group Emerging Markets Growth Fund (LUX) B USD | LU0100551489 | 7,55% | -3,03% | 8,79% | -17,44% | 9,58% | 13,62% |

| Robeco Emerging Stars Equities D EUR | LU0254836850 | 7,23% | -4,27% | 13,36% | 1,98% | 15,85% | 15,55% |

| Fidelity Funds - Sustainable Emerging Markets Ex China Fund A-ACC-USD | LU2546391173 | 7,21% | -2,71% | 14,86% | |||

| Stewart Investors Global Emerging Markets Leaders Fund I (Accumulation) EUR | IE00BFY84Y60 | 7,15% | 0,83% | 16,26% | 5,64% | 15,04% | 12,07% |

| IQAM Equity Emerging Markets (RT) | AT0000823281 | 7,10% | -1,03% | 13,67% | -3,30% | -8,00% | 12,39% |

| CT (Lux) Global Emerging Market Equities Fund AEH EUR hedged acc | LU0198729559 | 7,02% | -3,37% | 13,62% | -34,02% | -9,01% | 19,91% |

| UBS (Lux) Equity SICAV - Global Emerging Markets Opportunity (USD) P-acc | LU0328353924 | 6,69% | -3,33% | 10,48% | -18,16% | -1,08% | 14,05% |

| Danske Invest SICAV - Emerging Markets Sustainable Future Class A | LU1116403194 | 6,59% | -1,10% | 11,74% | -12,85% | 9,83% | 12,18% |

| Comgest Growth Emerging Markets Plus EUR Acc | IE00BK5X3N72 | 6,13% | -0,18% | 9,98% | -11,23% | 12,62% | |

| Carmignac Emergents A EUR acc | FR0010149302 | 5,95% | -4,15% | 8,57% | -10,44% | 32,29% | 15,52% |

| UBS (Lux) Institutional Fund - Emerging Markets Equity AA | LU0200130796 | 5,93% | -3,29% | 10,17% | -18,40% | 3,38% | 15,05% |

| JPMorgan Funds - Emerging Markets Small Cap A (perf) (acc) - EUR | LU0318933057 | 5,90% | 0,11% | 12,95% | -3,88% | 25,07% | 11,07% |

| Comgest Growth Emerging Markets USD Acc | IE0033535182 | 5,86% | -0,63% | 9,34% | -14,28% | -15,03% | 13,70% |

| Nordea 1 - Stable Emerging Markets Equity Fund BP-USD | LU0634510886 | 5,60% | -3,54% | 7,54% | 10,63% | 13,94% | 11,52% |

| HSBC MSCI Emerging Markets Small Cap ESG UCITS ETF USD Acc | IE000W080FK3 | 5,37% | -1,16% | 11,22% | |||

| Stewart Investors Global Emerging Markets Sustainability Fund VI Acc EUR | IE00BFY85R68 | 5,30% | -0,36% | 13,99% | -3,50% | 21,56% | 11,67% |

| ÖkoWorld Growing Markets 2.0 C EUR | LU0800346016 | 5,30% | 0,53% | 14,08% | -13,98% | 45,10% | 15,46% |

| Invesco Developing Markets Equity Fund A-Acc | LU2014290212 | 5,28% | -3,18% | 9,88% | -16,61% | -4,12% | 13,46% |

| Stewart Investors Global Emerging Markets Leaders Fund A Acc £ | GB0033873919 | 4,65% | 1,04% | 12,68% | 2,07% | 10,92% | 11,36% |

| Fidelity Funds - Sustainable Emerging Markets Equity Fund A-USD | LU1102505762 | 4,40% | -2,34% | 8,17% | -16,81% | 10,06% | 14,81% |

| Stewart Investors Global Emerging Markets Sustainability Fund A Acc EUR | GB00B64TSB19 | 4,28% | -0,46% | 12,91% | -5,17% | 16,40% | 11,65% |

| Invesco FTSE Emerging Markets High Dividend Low Volatility UCITS ETF | IE00BYYXBF44 | 4,20% | -1,88% | 9,81% | 3,52% | 7,65% | 12,02% |

| Vontobel Fund - Emerging Markets Equity A-USD | LU0040506734 | 4,16% | -0,72% | 7,89% | -18,35% | -9,99% | 11,02% |

| Comgest Growth Emerging Markets ex China USD I Acc | IE00BF29DW24 | 3,96% | -0,04% | 11,41% | -8,89% | 7,73% | 16,23% |

| BlackRock Global Funds - Emerging Markets Equity Income Fund A2 USD | LU0651946864 | 3,92% | -1,86% | 7,90% | -6,38% | 9,53% | 12,52% |

| BlackRock Global Funds - Emerging Markets Fund A2 USD | LU0047713382 | 3,89% | -1,07% | 7,83% | -20,34% | 1,88% | 13,73% |

| Keppler-Emerging-Markets-INVEST | DE000A0ERYQ0 | 2,56% | -2,50% | 7,24% | -2,86% | 15,67% | 12,69% |

| Global Advantage Funds - Emerging Markets High Value A | LU0047906267 | 2,28% | -1,30% | 8,89% | 2,97% | 22,42% | 13,86% |

| BlackRock Strategic Funds - Emerging Markets Equity Strat A2 USD | LU1289970086 | 2,21% | -4,83% | 7,60% | 27,98% | 27,88% | 16,77% |

| Carmignac Portfolio-Emerging Patrimoine A EUR Acc | LU0592698954 | 2,18% | -2,36% | 4,94% | -5,38% | 16,56% | 10,44% |

| UBS (Lux) Equity SICAV - Global Emerging Markets Opportunity USD EUR hdg P-acc | LU1676115329 | 1,79% | -6,00% | 8,67% | -28,90% | -15,13% | 17,61% |

| T. Rowe Price Funds SICAV - Emerging Markets Equity Fund A | LU0133084623 | 1,22% | -2,69% | 4,50% | -25,21% | -15,94% | 13,99% |

| HSBC MSCI Emerging Markets Islamic ESG UCITS ETF | IE0009BC6K22 | -0,79% | -5,69% | 4,32% |

Quelle: FVBS professional

Diesen Beitrag teilen: